Dear HHSE Friends & Followers - In response to shareholder requests, a substantial blog / disclosure is presented below, covering a wide range of issues:

1). TCA RESOLUTION STATUS / UPDATE - As disclosed recently, the attorneys for HHSE filed a motion to set-aside the TCA judgment against HHSE (and related parties), due to obvious errors and demonstrably false statements in their filing for a judgment - as well as the undisputed, mathematical evidence that HHSE has actually - significantly - overpaid TCA well past the amounts that TCA is legally allowed to collect (including maximum, legal default interest rates). As of Friday, Jan. 29, TCA's attorney's had not filed a response to the HHSE motion. While HHSE's attorneys are confident in the Company's position, until the default is formally "set-aside" or vacated, HHSE will still be encumbered from obtaining traditional corporate credit lines.

To be clear:

a). TCA has acknowledged in writing the receipt of all of the HHSE payments;

b). The amount of the acknowledged payments made by HHSE (or on HHSE's behalf) to TCA is $396,896.00;

c). The total amount of loan proceeds that HHSE received from TCA in May of 2013 was $245,000;

d). If HHSE decides to concede on the point that TCA is actually entitled to receive an additional $55,000 in "origination" fees and costs (and therefore, the "starting amount" for the calculation of interest would be $300,000 instead of $245,000) - then HHSE has STILL OVERPAID TCA by $28,439.65, which assumes 18% (maximum legal interest) as of January, 2014 (which conforms to the TCA Auditors letter received by HHSE).

e). If the court decides that TCA is entitled to receive an additional $100,000 as an "Investment Advisory Fee" for advisory services never performed - and that this terminology is not merely an attempt to circumvent the maximum legal usury rates - then HHSE has STILL overpaid TCA by virtue of issuing 10-mm shares in June (2013) which were valued at $123,000. However, HHSE Attorneys feel that the case law for inventing different "terms" for nonexistent services are "interest by another name" and will likely not be deemed enforcable (or payable).

f). HHSE has requested that TCA return the 10-mm shares that were issued in June (2013) as "collateral" or "payment" for the "Investment Advisory Fee" to TCA. However, TCA has not returned the shares, and had been previously attempting to force payment from HHSE in cash or this issue. HHSE believes that TCA is unable to return the shares because (at TCA's request), the stock certificate was issued to Caledonian Bank, Cayman Islands, and that subsequent to the S.E.C. filing enforcement actions against them, Caledonian Bank filed for bankruptcy. Therefore, it seems likely that the 10-mm HHSE share certificate is not accessible to TCA - which under law would constitute constructive payment for the "Investment Advisory Fee" disregarding whether or not TCA is legally entitled to charge fees to a loan for services never performed.

g). If the Court rules that TCA is NOT entitled to an additional $100,000 in interest (under the disguise of "Investment Advisory Fees"), then TCA will need to return the shares (likely NOT possible) or pay back to HHSE the value of the shares as of date of issuance. If the court rules against the validity of this "fee" then then entire amount will have been illegal "usurious" interest, which is subject to statutory 200% penalties. So HHSE would be entitled to get paid back DOUBLE the total amount of usurious interest paid.

h). TCA will likely adopt the position that they are entitled to receive the $100,000 for "Investment Advisory Fees" because Hannover House signed the document with this provision. They may also try to cite as "services" provided that they repeatedly demanded that HHSE dump low-priced shares to a specific "toxic debt conversion" company that met "TCA's approval," and that this demand (to pay them back through a horrible methodology) constituted "advice" to the Company. However, there is also an issue of fiduciary conflict if they are both the senior creditor AND separately being compensated for "Investment Advisory" services, especially if the advice is self-serving to the detriment of the Company. TCA will not want the court to rule that this fee is simply "interest by another name," but it's very difficult to envision any form of winning argument for TCA. The case law against predatory lenders has dealt with all of these "tricks" to try and circumvent the maximum legal interest rate laws.

i). ALL COLLECTION ENFORCEMENT ACTIONS and TCA attempts to execute on the Judgment in Arkansas have been HALTED, due to the preponderance of evidence that HHSE has overpaid TCA.

2). FORM 10 STATUS - HHSE Form 10 Registration document is completed, subject only to the updated items as described below.

3). 2014 / 2015 FULL YEAR AUDITS - The new auditors for HHSE are PCAOB Certified with a spotless record for accuracy and compliance. There are two major issues that impacted the completion of this task in January.

a). HHSE has been informed that the Company must complete the internal controls & compliance documentation on the accounting of activities for the Company in a format that will fully conform to the Sarbanes-Oxley Act 404, or face the likelihood of significant footnotes to the auditor's report. While this internal procedure standard does not require that HHSE do anything differently than the methodologies used at present, it does require a voluminous set of internal documents describing each procedure (from how a cost is applied to a specific title or expenditure account, to how the company recognizes contract-receivables from financing ventures such as the manner that Netflix pays out over 2-year terms).

b). The HHSE Film Library Report is missing over 220 titles that have been added since 2010 (the last date that the library was reviewed and evaluated by an outside party). The new auditors have encouraged HHSE to immediately complete a current (12-31-2015) Library Valuation Report - and to utilize one of the top six specialty firms in that industry. HHSE has already commenced this engagement and new library report.

Both items (3a and 3b above) are expected to be completed in the next few weeks, and will become items referenced within (or directly included within, either fully or in abbreviated formats) to the Company's Form 10-registration statement and Auditors report. Company asks shareholders to note that once HHSE's work portions are submitted to the Auditors and Film Library Valuation Company, that the control over completion timing is no longer under Company's control.

c). NEW AUDITING COMPANY and NEW LIBRARY VALUATION COMPANY - Some shareholders have asked if HHSE is going to formally announce the new auditors and the new Library Valuation firm prior to the filing of the Form 10 registration. HHSE counsel informs management that since HHSE is not yet fully reporting and fully registered, that such a disclosure in advance of the Form 10 Registration is not required. In respect of prior "interventions" by shareholders in contacting auditors, HHSE prefers to minimize these unprofessional distractions and enable our service providers to do their work without interference.

3a). 2015 YEAR END RESULTS - Full year (2015 results) are expected to be released on or before February 12, 2016.

4). UPDATED LIBRARY VALUATION STUDY - The addition of 220+ titles not currently carrying any value to the HHSE library, is expected to more than offset any write-downs due to a general decline in catalog sales for DVDs over the past five years. Other revenue streams (most notably Video-On-Demand) have offset much of the decline in physical goods sales, but only for certain genres of movies (and for current theatrical releases); older direct-to-video titles have, for the most part, under-performed at the income levels previously forecasted... while theatrical titles have over-performed. HHSE management will be looking at these market trends, as well as title-specific sales histories for the past three-to-five years, in order to extrapolate a realistic and achievable value for each of the titles in the Hannover House / Medallion Releasing film libraries.

5). STATUS OF NEW VENTURES / PRODUCTIONS / RELEASES;

5a). "ENCOUNTER" - Beginning on January 22nd, HHSE released the "found-footage" horror-thriller, "ENCOUNTER" to theatres in Key (primarily in the top 25 DMA) markets. The film has already played in New York, Los Angeles, Atlanta, Tampa-St. Petersburg, Minneapolis-St. Paul, Orlando, Sacramento, Charlotte, Raleigh, Columbus (OH) and Cincinnati. Over the next two weeks, the film will be expanded into Chicago, Dallas, Detroit, Seattle, Portland, San Antonio, Oklahoma City and Memphis. "ENCOUNTER" will be released onto home video and V.O.D. Streaming Platforms on April 26. Walmart and Netflix deals are completed... Redbox, Best Buy and Target placements are in discussions / pending buyer's final approval. HHSE plans to work with the director of "ENCOUNTER" (Susannah O'Brien of Sahara Vision Production), on additional films she is making, including "HALLUCINOGEN" and "THE DOLL."

5b). "BORRAR DE LA MEMORIA" - This title had a single screen test market in the Los Angeles metro area on Jan. 22nd. The theatrical release is now being expanded into Phoenix, Tucson, San Antonio, Houston, Dallas-Ft. Worth and Denver. This film had a 200+ theatre theatrical release in Mexico (it's country of origin).

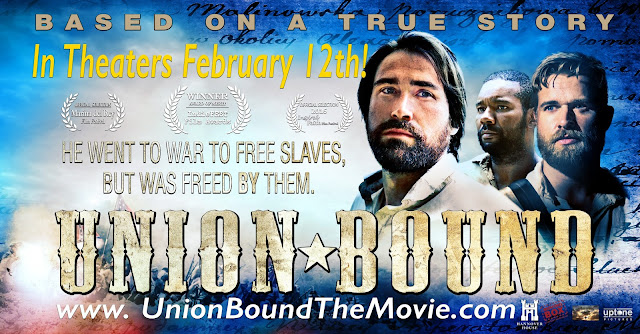

5c). "UNION BOUND" - In order to better coordinate cross-promotional activities (involving over 50 mega-church promotions, plus the World Net Daily website and publishing divisions), "UNION BOUND" has been expanded, and delayed for theatrical release until April 22nd. A formal press release will be posted this coming week (Feb. 1 - 5); previously, HHSE and Uptone Pictures planned to release the film on February 12, to coordinate with Black History Month promotions.

6). INTERNATIONAL SALES - CANNES MARCHE DU FILM - As will become evident over the next few weeks of press announcements, HHSE / Medallion Releasing will have a significant, high-profile line-up of theatrical productions for sale to international buyers. The best forum to launch this aggressive International Licensing activity will be the Cannes Film Festival / Marche Du Filme in Cannes, France, May 9 - 22. HHSE / Medallion will have a sizable "seller's booth" at the Palais Convention Center - and will be screening completed films and "promo reels" (of films already in production) for major buyers.

7). CORPORATE DEBTS / BALANCE SHEET IMPROVEMENTS - As will be seen with the OTC markets 12-31-2015 filings (and reiterated on the Form 10 / audited filings), HHSE significantly reduced its total debts during 2015 - and most notably during Q4. The reductions in debt during Q4 - cumulatively totalling over $400,000 - were from non-stock related transactions, including straight cash payments from the company's improving revenue streams. HHSE management wants shareholders to recognize the unanimous commitment to grow the company and improve the balance sheet - which is finally being completed without new dilution equity issuances.

8). DVD / BLU-RAY & V.O.D. RELEASE SCHEDULE UPDATES - As a lengthy list of new release titles have already been formally announced to the trade (key buyers), HHSE will also be releasing a summary of new releases through June (2016) to shareholders and general media in the next few days.

Welcome

Welcome to the Hannover House Investor Relations Blog

Saturday, January 30, 2016

Wednesday, January 27, 2016

HHSE Pops Another NEW RELEASE into WALMART!

Dear HHSE Friends & Followers - We're excited to add another Walmart placement to our roster, with the May 3rd release of "HEAR ME MOVE" - a hip-hop, urban dance spectacular from Green Apple and Hannover House!

https://www.youtube.com/watch?v=fnbQclAnbgU

https://www.youtube.com/watch?v=fnbQclAnbgU

Tuesday, January 19, 2016

Exciting week of Activities for HHSE!

Happy Tuesday HHSE Friends! Quite a bit is in store for this week at Hannover House. Here's a quick preview:

1). L.A. SALES MEETINGS - C.E.O. Eric Parkinson is in Los Angeles for a series of meetings and activities, including high-level sales presentations with Netflix, Redbox and International Rights Licensors (the latter being in preparation for next month's EFM-Berlinale Market).

2). ENCOUNTER PREMIERE - while this is not a big theatrical release (only a dozen markets), "Encounter" is still getting a first class launch from HHSE. A special event premiere will be held tonight at Raleigh Studios in Hollywood, and is expected to feature some very special guests!

3). ENCOUNTER OPENING - yes, a few theaters will launch this Friday. HHSE will expand the release if it is merited. A few theaters in selected markets will also open the Mexican political-thriller, BORRAR DE LA MEMORIA.

4). TCA COURT FILINGS - last Wednesday, HHSE attorneys filed a motion to set aside the TCA judgment on the basis of fraud - and to recapture the substantial overpayments made by HHSE. A hearing is anticipated imminently - meanwhile, TCA is functionally blocked from ongoing collection activities. The HHSE attorneys believe that the company is in a very good position to receive the statutory 2-X penalties back for all "usurious" rates assessed by TCA (under their guise of "advisory fees" and "other charges" that were essentially misnomers for Interest).

A technical glitch in posting to this blog program from mobile devices is impeding the upload of these court filings - however, scans of the primary attorney's document are posted onto a Hannover FaceBook page:

https://m.facebook.com/story.php?story_fbid=1146543742052951&id=100000920076231

5). BONOBOS VIDEOS! The first shipment of DVDs of "Bonobos: Back to the Wild" resulted in a 56% sell-thru at Walmart Canada nationwide locations during the title's first 10-days! This is a good sign for how the USA video market will likely respond when "Bonobos" hits the shelves this spring! It definitely did not hurt to have a 13-minute feature story on the acclaimed CBS 60-Minutes program - Thank you, Anderson Cooper!

6). MORE TO FOLLOW...

1). L.A. SALES MEETINGS - C.E.O. Eric Parkinson is in Los Angeles for a series of meetings and activities, including high-level sales presentations with Netflix, Redbox and International Rights Licensors (the latter being in preparation for next month's EFM-Berlinale Market).

2). ENCOUNTER PREMIERE - while this is not a big theatrical release (only a dozen markets), "Encounter" is still getting a first class launch from HHSE. A special event premiere will be held tonight at Raleigh Studios in Hollywood, and is expected to feature some very special guests!

3). ENCOUNTER OPENING - yes, a few theaters will launch this Friday. HHSE will expand the release if it is merited. A few theaters in selected markets will also open the Mexican political-thriller, BORRAR DE LA MEMORIA.

4). TCA COURT FILINGS - last Wednesday, HHSE attorneys filed a motion to set aside the TCA judgment on the basis of fraud - and to recapture the substantial overpayments made by HHSE. A hearing is anticipated imminently - meanwhile, TCA is functionally blocked from ongoing collection activities. The HHSE attorneys believe that the company is in a very good position to receive the statutory 2-X penalties back for all "usurious" rates assessed by TCA (under their guise of "advisory fees" and "other charges" that were essentially misnomers for Interest).

A technical glitch in posting to this blog program from mobile devices is impeding the upload of these court filings - however, scans of the primary attorney's document are posted onto a Hannover FaceBook page:

https://m.facebook.com/story.php?story_fbid=1146543742052951&id=100000920076231

5). BONOBOS VIDEOS! The first shipment of DVDs of "Bonobos: Back to the Wild" resulted in a 56% sell-thru at Walmart Canada nationwide locations during the title's first 10-days! This is a good sign for how the USA video market will likely respond when "Bonobos" hits the shelves this spring! It definitely did not hurt to have a 13-minute feature story on the acclaimed CBS 60-Minutes program - Thank you, Anderson Cooper!

6). MORE TO FOLLOW...

Thursday, January 14, 2016

Conflicting Dates regarding the Form 10-12(g) Filing

Good evening HHSE Friends & Followers - Management has received quite a few emails today from shareholders asking "will the company will meet the filing deadline TOMORROW (Jan. 15) for the Form 10-12(g) Registration." For clarity, we ask that shareholders refer to the dates of the two recent S.E.C. Filings which addressed this subject, both of which list January, 2016 as the anticipated filing target month:

1). The 10Q report for the period ending 9/30/2015 lists on page 20, Item 11 under Supplemental Disclosures that the filing of the Form 10-12(g) was "expected to be filed on or before January 15, 2016." This 10-Q report was completed, dated and effective as of Nov. 15, 2015.

2). The Form 8 Information Statement, completed , dated and effective as of November 23, 2015 provided a more current update on this issue, by stating in item 8.01-e that "...The Company anticipates a re-filing of the Form 10-12(g) Registration Statement in January, 2016." It is important to note that this Form 8 Information Statement update is less "date" specific - as the completion date of the only item outside of HHSE's direct control for the Form 10-12(g) filing (the audits) - could not be projected with such accuracy.

Despite the clarity of the effective dates of these two filings, the publication dates onto Edgar database were actually reversed, due to the complexity of the formatting requirements for the 10-Q report - which created delays in the publication of that filing. Specifically:

a). The 10-Q report, completed on Nov. 15, did not become "publicly posted" until Dec. 2 on the Edgar Database. All of the data within the report, however, conformed to the report's date of Nov. 15.

b). The Form 8 report, completed on Nov. 23, did not become "publicly posted" onto the Edgar Database until Nov. 24 - even though it contained an update to the earlier dated 10-Q - which was still being formatted for publication.

In the ideal world - where HHSE Managers have lots of extra time (!!!) - the 10-Q could have been updated if the Company were willing to sign-off on a later date for the 10-Q filing (which was actually DUE on Nov. 15), and to effect a further review and update of any other issues in the 10-Q that might have merited adjustment for activities transpiring in the eight days that followed Nov. 15 - before the Form 8 update was filed. But HHSE was informed that further 10-Q changes would result in more filing delays and costs, and that the Form 8 update already effectively superseded the older, dated 10-Q document.

Lastly, it may be relevant to note that the filing of the Form 10-12(g) is completely optional for HHSE, in that there is no "deadline" other than our own target goals. There are no S.E.C. penalties if HHSE files the registration on this day or that day - or not at all. The ramifications of not filing, however, are shareholder disappointment and an empowerment of the stock short sellers and price manipulators. So obviously, HHSE management has always viewed the filing of this registration statement as mandatory for the obliteration of the factors that have damaged the PPS.

If it appears that the auditors will not be completed prior to the end of January, or if there are any other issues that might cause a delay in the filing of the Form 10-12(g), then a further Form 8 update would be merited. Until then, we are on standby to submit the filing at a moment's notice (upon receipt of the final auditor's report).

1). The 10Q report for the period ending 9/30/2015 lists on page 20, Item 11 under Supplemental Disclosures that the filing of the Form 10-12(g) was "expected to be filed on or before January 15, 2016." This 10-Q report was completed, dated and effective as of Nov. 15, 2015.

2). The Form 8 Information Statement, completed , dated and effective as of November 23, 2015 provided a more current update on this issue, by stating in item 8.01-e that "...The Company anticipates a re-filing of the Form 10-12(g) Registration Statement in January, 2016." It is important to note that this Form 8 Information Statement update is less "date" specific - as the completion date of the only item outside of HHSE's direct control for the Form 10-12(g) filing (the audits) - could not be projected with such accuracy.

Despite the clarity of the effective dates of these two filings, the publication dates onto Edgar database were actually reversed, due to the complexity of the formatting requirements for the 10-Q report - which created delays in the publication of that filing. Specifically:

a). The 10-Q report, completed on Nov. 15, did not become "publicly posted" until Dec. 2 on the Edgar Database. All of the data within the report, however, conformed to the report's date of Nov. 15.

b). The Form 8 report, completed on Nov. 23, did not become "publicly posted" onto the Edgar Database until Nov. 24 - even though it contained an update to the earlier dated 10-Q - which was still being formatted for publication.

In the ideal world - where HHSE Managers have lots of extra time (!!!) - the 10-Q could have been updated if the Company were willing to sign-off on a later date for the 10-Q filing (which was actually DUE on Nov. 15), and to effect a further review and update of any other issues in the 10-Q that might have merited adjustment for activities transpiring in the eight days that followed Nov. 15 - before the Form 8 update was filed. But HHSE was informed that further 10-Q changes would result in more filing delays and costs, and that the Form 8 update already effectively superseded the older, dated 10-Q document.

Lastly, it may be relevant to note that the filing of the Form 10-12(g) is completely optional for HHSE, in that there is no "deadline" other than our own target goals. There are no S.E.C. penalties if HHSE files the registration on this day or that day - or not at all. The ramifications of not filing, however, are shareholder disappointment and an empowerment of the stock short sellers and price manipulators. So obviously, HHSE management has always viewed the filing of this registration statement as mandatory for the obliteration of the factors that have damaged the PPS.

If it appears that the auditors will not be completed prior to the end of January, or if there are any other issues that might cause a delay in the filing of the Form 10-12(g), then a further Form 8 update would be merited. Until then, we are on standby to submit the filing at a moment's notice (upon receipt of the final auditor's report).

Wednesday, January 13, 2016

Nice PRESS COVERAGE for HHSE's upcoming "UNION BOUND"

http://www.wnd.com/2016/01/journey-to-freedom-film-restores-image-of-american-honor/

Read more at http://www.wnd.com/2016/01/journey-to-freedom-film-restores-image-of-american-honor/#EwlE1zhquwFeJCwR.99

Davis continued, “It seems like we’ve lost this notion that we’re great and we’re an honorable country. And I think Joseph Hoover’s character is one of honor and integrity.”

Davis continued, “It seems like we’ve lost this notion that we’re great and we’re an honorable country. And I think Joseph Hoover’s character is one of honor and integrity.”

Read more at http://www.wnd.com/2016/01/journey-to-freedom-film-restores-image-of-american-honor/#EwlE1zhquwFeJCwR.99

WND EXCLUSIVE

JOURNEY TO FREEDOM: FILM RESTORES IMAGE OF AMERICAN HONOR

'Union Bound' tells true, inspiring story of slave helping captured soldier escape

Read more at http://www.wnd.com/2016/01/journey-to-freedom-film-restores-image-of-american-honor/#EwlE1zhquwFeJCwR.99

By Paul Bremmer

image: http://www.wnd.com/files/2016/01/Union-Bound-FB.jpg

‘Union Bound’ is in theaters Feb. 12 (Photo: Facebook)

In today’s morally confused world, many Americans have lost faith in the honor and integrity of their own country. Now one filmmaker wants to use the true story of one honorable American from long ago to bring back a sense of American pride.

“It seems to me, from what I read and what I see in my own personal life, it’s like we’ve lost some of that patriotism that we once were known for,” said Michael Davis, president of Uptone Pictures. “And I’m not saying it’s not there. I just want to bring it back to the forefront.”

image: http://www.wnd.com/files/2016/01/Union-Bound-cover.jpg

Joseph Hoover is the main character in the forthcoming movie “Union Bound,” set to hit theaters Feb. 12. The film tells the true story of Hoover, a Union soldier in the Civil War who was captured and imprisoned. He then found his way to freedom with the help of freed slaves. A companion book by WND Books, “Union Bound: He Went to War to Free the Slaves But Was Freed by Them,” will be in stores on May 2, 2016.

Davis, who produced and co-directed the movie, said he was attracted to this project because he is a history buff, and the Civil War was such a paramount moment in American history. He noted people still celebrate the anniversaries of various Civil War battles today, and some Americans even re-enact battles.

image: http://www.wnd.com/files/2016/01/Union-Bound-FB2.jpg

Thousands of Civil War re-enactors help with filming of battle scene in ‘Union Bound’ (Photo: Facebook)

Americans also still vigorously debate the Confederate flag, which is a remnant of the Civil War.

The Joseph Hoover story in particular jumped out at Davis as movie material because Hoover’s diary from 1864 is still around.

“I was able to read that diary, and it’s a fascinating account,” Davis told WND. “He wasn’t a super prolific writer, but he was very consistent, and I think a lot of it was to count the days or to pass the time or to keep him sane. … He talks about all these moments – where he was at and things that he saw – and so that immediately was something different.”

image: http://www.wnd.com/files/2016/01/Union-Bound-FB3.jpg

Joseph Hoover’s diary from 1864 (Photo: Facebook)

Davis said he was interested in telling the story of the Civil War through the eyes of this ordinary soldier who has not yet been mythologized by history.

“You kind of get the sentiment of this one guy – he’s not the general, he’s not the big Abraham Lincoln decision maker, he’s just one of the guys that’s in the trench going to war,” Davis said. “And what kind of captivated my interest was the fact that this was more of a human story than it was about the battles. It was really about the time, what was happening in 1864 on a day-to-day basis.”

According to Davis, Hoover was a farmer from Utica, New York, where he most likely didn’t interact much with black people. Hoover, like President Lincoln, fought the war not necessarily because he wanted to end slavery, but because he wanted to preserve the Union.

Hoover fought in the Battle of the Wilderness near Fredericksburg, Virginia, where Confederate forces captured him. They took him to Andersonville, a notorious prison camp. He was later transferred to a new stockade in Florence, South Carolina, from which he and a friend were able to escape because the stockade hadn’t been fully constructed yet.

The two escaped through the back of a hospital into the forest, but they did not know where they were. They eventually stumbled onto a plantation, where they ran into Jim Young, a slave whom Davis called “the hero of this whole story.” Young saved Hoover and his friend by directing them to the Underground Railroad, which they used to get to the Union army’s central command in the South, located in North Carolina.

Davis said Hoover underwent a transformation as a result of his ordeal. After his imprisonment in the South and interaction with slaves, the Northerner came to understand what slavery was all about. Incidentally, Hoover actually made two journeys to freedom over the course of the film.

“The story is not only a journey to freedom physically from the South, but a journey to freedom of his own understanding of what the world was all about,” Davis explained.

image: http://www.wnd.com/files/2016/01/Union-Bound.jpg

‘Union Bound’ is in theaters Feb. 12

Davis noted that Hoover showed his honor and integrity after he escaped from captivity. At that point, having survived a harrowing experience, he could have simply gone home and quit fighting in the war. But instead, he returned to the Union army. He knew he had sworn an oath to see the war through to the end, and he intended to keep his oath.

Davis believes Hoover set a good example for contemporary Americans, and he hopes viewers will adopt the former Union soldier’s values.

“I think society today, when we make an oath or we make a promise or we make an agreement, many times it’s just laughed off,” Davis said. “For me, from that perspective, I just want the viewer to walk away with this notion that we need to recapture or reignite those emotions of honor and integrity and the pursuit of liberty and justice and these core values of our society that I think as of late have been shoved aside.

“But I also want people to have a good time watching a movie!”

image: http://www.wnd.com/files/2016/01/Union-Bound-FB4.jpg

Scene from ‘Union Bound’

Copyright 2016 WND

Read more at http://www.wnd.com/2016/01/journey-to-freedom-film-restores-image-of-american-honor/#EwlE1zhquwFeJCwR.99

USA TODAY - National Consumer Ad Support for FEB. 12 Release of "UNION BOUND"

Dear HHSE Friends - Check out the national edition ad for UNION BOUND, for publication in the Feb. 5 weekender of USA TODAY! Placement is within the special section for BLACK HISTORY MONTH. Go HHSE!

Hadley Malcolm, USA TODAY

Hadley Malcolm, USA TODAY

USA TODAY No. 1 newspaper in daily circulation

(Photo: Bloomberg via Getty Images)

USA TODAY clinched the top spot again for total average daily circulation among U.S. newspapers, according to the semiannual Alliance for Audited Media report out Thursday.

USA TODAY daily weekday circulation grew to nearly 3.3 million for the period from October through March — up 94.4% from the same period last year, the report says. The newspaper's expansion with a daily print edition in 35 local newspapers owned by parent company Gannett, as well as growth in mobile app usage, contributed to the increase, according to the company.

The nation's largest newspaper had average daily print circulation of more than 1.8 million and digital circulation of more than 1.4 million.

"The print local edition is driving it this year," says Publisher Larry Kramer. "(It) has been a terrific success for us."

Kramer expects circulation to jump significantly with the next audit in the fall, as the data will include a more complete picture of the company's gradual launch into the 35 local markets, which was still underway when the AAM conducted the most recent survey.

Time spent on USA TODAY's mobile and tablet apps also continues to contribute to a circulation increase. "We have more people who go to our apps and spend more time on (them)," Kramer says.

The Wall Street Journal and The New York Times followed in second and third, respectively. The Wall Street Journal had a total average daily circulation of 2.3 million, while The New York Times had 2.1 million.

AAM totals include data for more than 600 newspapers, including digital editions, such as those on tablets or restricted websites, as well as branded editions, which include regional editions or those tailored for commuters. It does not include general website traffic.

Friday, January 8, 2016

ALGERIAN for official market screening at Berlinale / EFM in February!

Berlin, Germany in February? Probably won't need to pack a swimming suit, but a warm parka is advised!

Hannover House is proud to have THE ALGERIAN selected for an official screening at Berlinale / EFM next month. This is well timed for the outreach by HHSE and Medallion for international sales for this feature.

More information on the Berlinale' and HHSE activities there will be posted prior to the market launch.

Hannover House is proud to have THE ALGERIAN selected for an official screening at Berlinale / EFM next month. This is well timed for the outreach by HHSE and Medallion for international sales for this feature.

More information on the Berlinale' and HHSE activities there will be posted prior to the market launch.

L.A. "ENCOUNTER" Premiere - Red Carpet Madness!

No folks, the photo below is not an illustration, or a mannequin. If the young lady pictured looks incredibly similar to the infamous BARBIE doll, that's because it's a snapshot of VALERIA LUKYANOVA, otherwise known as "THE HUMAN BARBIE."

Valeria is one of more than a dozen celebrity guests and "horror film royalty" that are confirmed attendees for Hannover's Jan. 19 red-carpet premiere of "ENCOUNTER" at Raleigh Studios in Hollywood. Valeria has flown in from Russia for her motion picture debut in "THE DOLL" - coming later this year from Hannover House and Sahara Vision Productions. The plot for "THE DOLL" is outstanding and extremely commercial... we'd love to tell you more, but it's all under "press moratorium" to protect the storyline. But it's going to be a very fun project for HHSE to release to theatres this coming October (tentative release date).

GO HHSE!!

Valeria is one of more than a dozen celebrity guests and "horror film royalty" that are confirmed attendees for Hannover's Jan. 19 red-carpet premiere of "ENCOUNTER" at Raleigh Studios in Hollywood. Valeria has flown in from Russia for her motion picture debut in "THE DOLL" - coming later this year from Hannover House and Sahara Vision Productions. The plot for "THE DOLL" is outstanding and extremely commercial... we'd love to tell you more, but it's all under "press moratorium" to protect the storyline. But it's going to be a very fun project for HHSE to release to theatres this coming October (tentative release date).

GO HHSE!!

BOOM! 1/2-Page Ad for UNION BOUND in the Feb. 5 weekend edition of USA TODAY!

Dear HHSE Friends & Followers - Hannover House is proud to announce the purchase and placement of a 1/2-page, color ad in the National Weekend Edition of USA TODAY, for Feb. 5, 2016... as part of their special coverage for BLACK HISTORY MONTH. USA Today is the largest circulation newspaper in the country, with more than 3.5-million daily readers combined from their print and digital editions.

The UNION BOUND ad will clearly state that the film OPENS FRIDAY, FEBRUARY 12, and will list the website and trailer links, as well as contact information for Hannover House, including the ticker symbol (OTC: HHSE).

The film is opening in theatres in all of the top 40 largest markets, as well as additional secondary and targeted locations, with a total of 165 screens expected for the opening weekend. Home video and V.O.D. for UNION BOUND will be in July, 2016, with DVD and BluRay shipments occuring during Q2 (and reflected in Q2 revenues).

http://www.usatoday.com/story/money/business/2014/05/01/usa-today-daily-circulation/8573269/

The UNION BOUND ad will clearly state that the film OPENS FRIDAY, FEBRUARY 12, and will list the website and trailer links, as well as contact information for Hannover House, including the ticker symbol (OTC: HHSE).

The film is opening in theatres in all of the top 40 largest markets, as well as additional secondary and targeted locations, with a total of 165 screens expected for the opening weekend. Home video and V.O.D. for UNION BOUND will be in July, 2016, with DVD and BluRay shipments occuring during Q2 (and reflected in Q2 revenues).

http://www.usatoday.com/story/money/business/2014/05/01/usa-today-daily-circulation/8573269/

Thursday, January 7, 2016

Hannover's "ENCOUNTER" to kick-off Monthly Theatrical Schedule for 2016

Greetings HHSE Friends & Followers - we're only 15-days away from the Jan. 22 release of "ENCOUNTER" - from Hannover House. This supernatural-themed thriller will hit approximately 15 of the top 25 largest markets, with a potential expansion to 50+ additional markets. The Home Video and V.O.D. date is April 26 - with Walmart already on-board for a national placement.

"ENCOUNTER" is a level 3 theatrical release for Hannover House under the new theatrical program for 2016. Level 1 titles will be 500+ locations; Level 2 titles will be 100-to-499 locations; and Level 3 titles are less than 100 locations. Each of these designations has been set to conform to certain performance requirements of Subscription Video-On-Demand outlets (such as Netflix) or for market value enhancement levels related to the physical DVD and BluRay placements at retailers.

Initial Markets include NEW YORK, LOS ANGELES, CHICAGO, DALLAS-FT. WORTH, PHILADELPHIA, WASHINGTON DC, HOUSTON, ATLANTA, TAMPA-ST. PETERSBURG, MIAMI, PORTLAND, SACRAMENTO, CHARLOTTE and RALEIGH.

More to follow...

"ENCOUNTER" is a level 3 theatrical release for Hannover House under the new theatrical program for 2016. Level 1 titles will be 500+ locations; Level 2 titles will be 100-to-499 locations; and Level 3 titles are less than 100 locations. Each of these designations has been set to conform to certain performance requirements of Subscription Video-On-Demand outlets (such as Netflix) or for market value enhancement levels related to the physical DVD and BluRay placements at retailers.

Initial Markets include NEW YORK, LOS ANGELES, CHICAGO, DALLAS-FT. WORTH, PHILADELPHIA, WASHINGTON DC, HOUSTON, ATLANTA, TAMPA-ST. PETERSBURG, MIAMI, PORTLAND, SACRAMENTO, CHARLOTTE and RALEIGH.

FILM WEBSITE: www.EncounterMovie.net

LINK TO TRAILER: https://www.youtube.com/watch?v=shVNvm5N45s

MPAA RATING: Anticipate PG-13 (rating is occurring this Friday, Jan. 8).

83 Mins., Color, Dolby DTS Stereo, 1:1.85 Aspect Ratio.

More to follow...

Monday, January 4, 2016

Happy New Year from HHSE!

Greetings HHSE Friends & Followers - January 2016 represents the beginning of the new business model for Hannover House and Medallion Releasing: a structure in which theatrical releases drive the home video / VOD / International and Television revenues for the company (just like the majors). Quite a bit is happening every week in January as we set the stage for a dramatic increase in revenues, visibility and market share for HHSE. While we will utilize this blog site for many of the daily updates, some items will also be addressed through S.E.C. and OTC Markets filings or traditional press announcements. Here's a quick snapshot of some previously announced projects:

CORPORATE VENTURES

1). High Visibility Sales Venture for MEDALLION INTERNATIONAL at Berlin and Cannes.

2). Consumer Launch of VODWIZ site / OTT with new supplier partner product.

3). Form 10-12g Filing (including four-years of audits, 2012-2013-2014-2015).

4). Retirement / Elimination of all forms of "toxic" debt, in favor of traditional financing.

5). Litigation As Plaintiff: HHSE pursuing four significant legal / civil court matters.

THEATRICAL RELEASES

1). ENCOUNTER

2). UNION BOUND

3). BORRAR DE LA MEMORIA

4). ACCIDENTAL EXORCIST

5). UNLIMITED

6). Seven (7) Additional Titles, already acquired but not yet individually announced.

HOME VIDEO & V.O.D. RELEASES

1). DANCIN' IT'S ON

2). THE ALGERIAN

3). BONOBOS: BACK TO THE WILD

4). DAY OF REDEMPTION

5). ALL TWELVE THEATRICAL TITLES (above)

6). Sixteen (16) Additional Titles, already acquired but not yet individually announced.

PRODUCTIONS LAUNCHING (PRINCIPAL PHOTOGRAPHY IN 2016)

1). THE SUMMONING

2). LEGEND OF BELLE STARR

3). MOTHER GOOSE: JOURNEY TO UTOPIA

4). DELIRIUM

5). OVER THE EDGE

6). Four (4) Additional Projects, already acquired but not yet individually announced.

While Hannover House has no control over the market conditions that ultimately drive the Company's stock price, the management is confident that the activities now in motion will establish a solid foundation to support a far higher PPS than the current trading levels.

More to follow...

CORPORATE VENTURES

1). High Visibility Sales Venture for MEDALLION INTERNATIONAL at Berlin and Cannes.

2). Consumer Launch of VODWIZ site / OTT with new supplier partner product.

3). Form 10-12g Filing (including four-years of audits, 2012-2013-2014-2015).

4). Retirement / Elimination of all forms of "toxic" debt, in favor of traditional financing.

5). Litigation As Plaintiff: HHSE pursuing four significant legal / civil court matters.

THEATRICAL RELEASES

1). ENCOUNTER

2). UNION BOUND

3). BORRAR DE LA MEMORIA

4). ACCIDENTAL EXORCIST

5). UNLIMITED

6). Seven (7) Additional Titles, already acquired but not yet individually announced.

HOME VIDEO & V.O.D. RELEASES

1). DANCIN' IT'S ON

2). THE ALGERIAN

3). BONOBOS: BACK TO THE WILD

4). DAY OF REDEMPTION

5). ALL TWELVE THEATRICAL TITLES (above)

6). Sixteen (16) Additional Titles, already acquired but not yet individually announced.

PRODUCTIONS LAUNCHING (PRINCIPAL PHOTOGRAPHY IN 2016)

1). THE SUMMONING

2). LEGEND OF BELLE STARR

3). MOTHER GOOSE: JOURNEY TO UTOPIA

4). DELIRIUM

5). OVER THE EDGE

6). Four (4) Additional Projects, already acquired but not yet individually announced.

While Hannover House has no control over the market conditions that ultimately drive the Company's stock price, the management is confident that the activities now in motion will establish a solid foundation to support a far higher PPS than the current trading levels.

More to follow...

Subscribe to:

Posts (Atom)