Greetings HHSE Friends & Followers - significant steps have occurred over the past four days to clear the path for the Form 10 Registration and S1 Offering for HHSE.

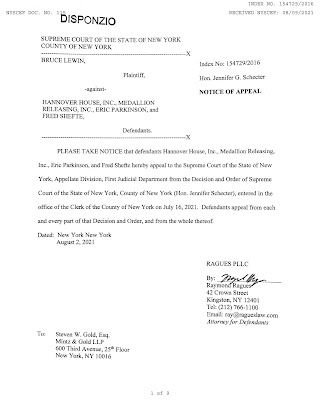

The Arkansas judge in the Lewin foreign default matter decided against opening the case for adjudication in Arkansas. While the Arkansas Code of Civil Procedures Rule 55 ss 16-601 allows for foreign defaults to be contested (with specific emphasis on defaults earned through technicalities or fraud against the original court - as opposed to the merits of a claim), the amount of time that had passed since the New York judgment was filed in Arkansas (despite no collection efforts against HHSE), swayed the judge to defer the matter to the original jurisdiction (NY). While HHSE has an active appeal in process in New York, our counsel there is targeting December as the hearing date, which would keep this Lewin matter unresolved until that time. Rather than delay our ability to file the Form 10 (without the S.E.C. litigation concerns), we have decided NOT to wait on the appeal process, but to instead move to settlement with Lewin. Accordingly, our New York counsel is working diligently with the lead NY Counsel for Lewin to effectuate a settlement that we expect to have completed and announced in the next few days.

This leaves only two problematic cases to resolve, re-open or dismiss: the bizarre UPTONE judgment (which occurred AFTER a fully performed settlement agreement was in place) and the DAISY WINTERS judgment - which ALSO occurred after HHSE fully satisfied the licensor's terms for a non-litigious dissolution. Los Angeles based counsel for HHSE on these two cases feels that the motions to set-aside the UPTONE matter will be filed today or tomorrow... and that the DAISY WINTERS motions will be filed next week.

The crucial goal for HHSE is to clear-the-path for the registration and offering, as the company has received subscription pledges for a substantial portion of the offering. The offering proceeds will primarily be used for the consumer support campaign of the MYFLIX venture... but up to 30% will be accessible for prior payables or obligations. So, the offering is a solution for fueling the new business model, as well as for cleaning up any final obligations from the prior DVD based business.

There will be two exciting news items this week (both via wire service announcements), and some additional "twitter" postings of relevance. We believe that this is a great time for shareholders to look at the HHSE stock due to the temporary PPS dip - which resulted last week from uncertainty about the Lewin case. Many shareholders, traders and brokers have shared their predictions with HHSE management that the resolution of these prior judgments - and the forward progress with HHSE corporate filings, projects and MyFlix - could and should fuel great shareholder enthusiasm and HHSE stock movement. We are about to find out if these stock prognosticators are right...

On a side note - Congratulations to the Oklahoma State University Medical School on the completion and opening of the World's Top-Acclaimed "Teaching Hospital" facility! This is a very impressive facility - and situated in the heart of the Cherokee Nation.