Northbank Entertainment has completed principal photography on one of the creepiest horror films to come out of the U.K. since the Hammer Films Era. The "Midnight Horror Show" combines the terror of "Texas Chainsaw Massacre" with the offbeat elements and characters of "Rocky Horror" to create an all new, thriller classic. Hannover House will be handling the release of this film in the USA and Canada, with 4K Entertainment handling distribution for the United Kingdom and Ireland. Checkout this link to Facebook to see a first look at some production stills of principal cast members, perfect for a Halloween announcement.

https://www.facebook.com/hannoverhouse/posts/669277259779604

Welcome

Welcome to the Hannover House Investor Relations Blog

Thursday, October 31, 2013

HHSE high-end Theatricals for 2014 - 2015 to 20th Century Fox

As mentioned in some prior filings and blogs, Hannover House has been very pleased with the strong sales results delivered by 20th Century Fox Home Entertainment on the HHSE title "Twelve," which continues to sell briskly each quarter. Accordingly, it was not a difficult decision to select Fox as the HHSE distribution partner for our higher-end releases in 2014 and 2015. The Hannover House direct distribution label will continue to sell directly to retailers and wholesalers, but the major theatrical titles will be handled for home video through Fox under this new structure. This is a "Best of Both Worlds" scenario for HHSE - and mimics the transitional distribution structure utilized by Lionsgate a few years back as they began their rapid ascension in the industry. As HHSE begins to announce each of the new, higher-end titles, we will be moving forward with the knowledge that the home video industry leader will be our distribution partner. Exciting times, more to follow! (New FOX photo to post to the HH Facebook page).

Monday, October 28, 2013

Court rules in favor of Hannover's motion to limit NBCal to actual amounts due...

Some shareholders have asked for an update on the litigation

matter between Hannover House and the National Bank of California. As of Friday, the court finally made a ruling

that was exactly what the attorneys for Hannover House had been seeking (and was not what NB Cal had been seeking).

As a point of background, Hannover borrowed "Prints & Ads" funds from NB Cal for the release of the film "All's Faire In Love." The original draw down against the $500,000 credit line had been reduced down to about $320,000 during the first year, and an "oral" agreement had been made between Hannover House and the bank officers to extend the note for another year. The rationale' behind the extension of the note was that the subscription V.O.D. payments from Netflix were substantial (about $225,000 gross), and that ongoing home video sales and a pending sale to Basic Cable TV would fully retire the balance.

In support of the agreement to extend the note, NB Cal sent documents to Hannover House, which were promptly signed and returned to the bank. However, unbeknownst to Hannover House (and as testified, to the Bank as well), one of the documents referred to in the amended note was not sent to Hannover House. The first quarterly installment was due at the end of January, 2013. During the final months of 2012, the bank officer at NB Cal left and was replaced. In early January, rather than contact Hannover House to determine the status of the "missing document," the bank's attorneys preemptively filed a lawsuit for breach of the original note. During discovery, it became clear that it was the bank's negligence in not sending the missing document to Hannover House to fully complete the amendment agreement. When this document was finally provided (June, 2013), Hannover House promptly signed and returned it, along with an agreement to immediately "catch up" on payments that Hannover had withheld as a result of the lawsuit being filed. The bank did not accept these terms, and pressed forward in hope of also winning the right to collect additional penalties and attorney's fees. Rather than accept this obligation (about $100,000), Hannover instructed counsel to file an opposition to some aspects of the bank's filing for judgment, but not disputing the actual balance due. The point that Hannover wanted to make was that the bank should have NEVER filed the lawsuit... that all of the documents provided to Hannover House were promptly signed... and that quarterly payments stopped only after the bank filed the lawsuit. The court had to review a tremendous amount of evidence and pleadings. but ultimately agreed with the conclusions of Hannover's position.

In her opinion released last Friday, U.S. District Court Judge Margaret M. Morrow writes "... it is therefore now undisputed that defendant signed the note, delivered it to NBC, and that the amendment has taken effect" (page 9, line 6). As a result, the attempts by NBCal's attorneys to enforce interest penalties (and to add-in their own legal fees) was denied, and the amount determined as owed was precisely the amount that Hannover House acknowledged and was performing on prior to the filing of the lawsuit. As oft stated in our filings to the court (and our disclosure documents on the OTC Markets site), Hannover never denied the validity of the loan balance; the Company only disputed the due date of the loan and the bank's subsequent attempts to charge penalties and legal fees.

In her Conclusion, Judge Morrow writes: "... For the reasons stated, the court grants in part and denies in part NBC's motion for partial summary judgment" (Page 15, line 2).

The amount due on this item is the amount that Hannover has listed in our payables and disclosures, namely $331,466, plus $25,574 in interest. The Company expects this debt to be fully covered by the balance remaining on the Netflix SVOD contract, plus the Basic Cable TV sale and current home video (budget bin) revenues. Hannover was very pleased with the quality of the legal work and pleadings from our L.A. Counselors, Mark Hankin and Nima Darouian.

While there are certainly "performing obligations" still active as a result of prior litigations, Hannover House is pleased to hear from our corporate counsel that there are no other "open cases" awaiting adjudication before the courts. The long struggle to overcome the debts from "Twelve" (and that title's impact to our cash flow), has made it past the court-litigation stages and is now a part of our performing debt obligations. Removing the distraction and cost of defendant litigation is a major step forward, and marks the closing of a journey we do not wish to ever travel on again.

As a point of background, Hannover borrowed "Prints & Ads" funds from NB Cal for the release of the film "All's Faire In Love." The original draw down against the $500,000 credit line had been reduced down to about $320,000 during the first year, and an "oral" agreement had been made between Hannover House and the bank officers to extend the note for another year. The rationale' behind the extension of the note was that the subscription V.O.D. payments from Netflix were substantial (about $225,000 gross), and that ongoing home video sales and a pending sale to Basic Cable TV would fully retire the balance.

In support of the agreement to extend the note, NB Cal sent documents to Hannover House, which were promptly signed and returned to the bank. However, unbeknownst to Hannover House (and as testified, to the Bank as well), one of the documents referred to in the amended note was not sent to Hannover House. The first quarterly installment was due at the end of January, 2013. During the final months of 2012, the bank officer at NB Cal left and was replaced. In early January, rather than contact Hannover House to determine the status of the "missing document," the bank's attorneys preemptively filed a lawsuit for breach of the original note. During discovery, it became clear that it was the bank's negligence in not sending the missing document to Hannover House to fully complete the amendment agreement. When this document was finally provided (June, 2013), Hannover House promptly signed and returned it, along with an agreement to immediately "catch up" on payments that Hannover had withheld as a result of the lawsuit being filed. The bank did not accept these terms, and pressed forward in hope of also winning the right to collect additional penalties and attorney's fees. Rather than accept this obligation (about $100,000), Hannover instructed counsel to file an opposition to some aspects of the bank's filing for judgment, but not disputing the actual balance due. The point that Hannover wanted to make was that the bank should have NEVER filed the lawsuit... that all of the documents provided to Hannover House were promptly signed... and that quarterly payments stopped only after the bank filed the lawsuit. The court had to review a tremendous amount of evidence and pleadings. but ultimately agreed with the conclusions of Hannover's position.

In her opinion released last Friday, U.S. District Court Judge Margaret M. Morrow writes "... it is therefore now undisputed that defendant signed the note, delivered it to NBC, and that the amendment has taken effect" (page 9, line 6). As a result, the attempts by NBCal's attorneys to enforce interest penalties (and to add-in their own legal fees) was denied, and the amount determined as owed was precisely the amount that Hannover House acknowledged and was performing on prior to the filing of the lawsuit. As oft stated in our filings to the court (and our disclosure documents on the OTC Markets site), Hannover never denied the validity of the loan balance; the Company only disputed the due date of the loan and the bank's subsequent attempts to charge penalties and legal fees.

In her Conclusion, Judge Morrow writes: "... For the reasons stated, the court grants in part and denies in part NBC's motion for partial summary judgment" (Page 15, line 2).

The amount due on this item is the amount that Hannover has listed in our payables and disclosures, namely $331,466, plus $25,574 in interest. The Company expects this debt to be fully covered by the balance remaining on the Netflix SVOD contract, plus the Basic Cable TV sale and current home video (budget bin) revenues. Hannover was very pleased with the quality of the legal work and pleadings from our L.A. Counselors, Mark Hankin and Nima Darouian.

While there are certainly "performing obligations" still active as a result of prior litigations, Hannover House is pleased to hear from our corporate counsel that there are no other "open cases" awaiting adjudication before the courts. The long struggle to overcome the debts from "Twelve" (and that title's impact to our cash flow), has made it past the court-litigation stages and is now a part of our performing debt obligations. Removing the distraction and cost of defendant litigation is a major step forward, and marks the closing of a journey we do not wish to ever travel on again.

Wednesday, October 23, 2013

Title Update & Shareholder Requests

Greetings HHSE Friends & Shareholders - As promised, today's blog covers the status of some of the new acquisitions, as well as current and pending productions that will fuel revenues and growth for HHSE in 2014. Additionally, there are other corporate / housekeeping and governance items that have been posted on the OTC Markets Disclosure filings from yesterday's Board of Director's Meeting.

Here's a quick recap on key items that Shareholder emails have addressed:

PRODUCTIONS:

a). WILD OATS - Road-trip Comedy with Shirley MacLaine (and an ever changing list of leads and supporting cast). Per the terms of the agreement with the producers, Hannover House will retain its rights to the film (i.e., North American home video / VOD), until such time (if ever) that the producers exercise their rights to buy out Hannover House. We're happy either way - and will be credited on the film, either way.

b). SHUCK & JIVE - A private investor group has agreed to finance this feature, with Hannover House serving as distributor, worldwide, in all media. Production is planned for June, 2014 with principal photography in Wichita, Memphis and N.W. Arkansas. Principal talent has not yet been signed.

c). MOTHER GOOSE - Pre-production continues to progress on this film; co-production (and financing) partnership agreements prohibit us from unilaterally disclosing more at this time. A formal press update is planned for Sundance in January.

d). THE MOTHMAN CHRONICLES - This creature-feature / thriller is currently in a hold-mode pending a work-out with private investors and the international distribution rights.

e). THE LEGEND OF BELLE STARR - Still in scripting stages; discussion underway regarding "how much dramatic license" can be taken to divert from historic record and surmised truths to tell a more compelling story with this movie?

f). SHADOW VISION - Pre-production will ramp up in January for a shoot in March; second unit sequences have already been shot and transferred to 4k file formats.

AUDIT & CORPORATE GOVERNANCE:

Company is in the process of hiring a new, full-time Controller / Bookkeeper to finish the reconciliation reports required by Hogan Taylor for the audit project. Previously candidates did not meet management's expectations or deadlines... and a recent attempt to utilize an outside accounting agency proved frustrating at best (they have been rarely available to come in and perform the required work); accordingly, the only way to get this finished is to cough-up the bucks for a qualified accountant, on staff, full-time, who understands the audit reporting format requirements. It is crucial to finish the accounting report items required by Hogan Taylor, in order that the audit be completed, and utilized for the Company's Form 10 Registration Filing with the S.E.C. The filing of the Form 10 will automatically elevate the stock to "OTCQB" status, and is expected to provide shareholder comfort and confidence with the Company's results.

CORPORATE FINANCING:

The Company is reviewing two financing proposals - each of which would provide an immediate, multi-million dollar cash infusion (without a negative impact to the A/S Equity Structure), and both of which would facilitate access to acquire and release high-profile "studio-level" films. There has been a lot of work over the past six weeks to bring these deals to the table - including a new distribution venture with 20th Century Fox Home Entertainment to accommodate the home media distribution portion of the structure; however, until a deal is done, there can be no assurance that one of these transactions will ultimately close and fund. Accordingly, the Company is pleased to continue on our proven course and business model of acquiring and distributing low-cost, direct-to-video releases and mid-level theatrical titles. With a broadening of Hannover's target "genre" releases (expanding from Sci-Fi / Horror to include Family, Drama, Comedy, Urban and Spanish titles), the Company is well positioned for substantial revenue growth in 2014 - even without one of these extraordinary "brass-ring" type of transformative ventures. There's a HUGE hole in the U.S. film distribution marketplace... the "major-independent" position that was previously occupied by LIONSGATE before they merged with SUMMIT to become (essentially) one of the new, Major Studios. The market contains about six "indies" in the lower-revenue spectrum... and six "Major Studios" in the stratosphere of mega-revenues... with no company occupying the $300-million to $500-million per year "Major Independent" spot. With continued hard work, the right product, and a little luck, Hannover House will strive to reach this position.

... more to come...

Mackenzie Foy, star of "PLASTIC JESUS" and the upcoming Christopher Nolan epic, "INTERSTELLAR."

Here's a quick recap on key items that Shareholder emails have addressed:

PRODUCTIONS:

a). WILD OATS - Road-trip Comedy with Shirley MacLaine (and an ever changing list of leads and supporting cast). Per the terms of the agreement with the producers, Hannover House will retain its rights to the film (i.e., North American home video / VOD), until such time (if ever) that the producers exercise their rights to buy out Hannover House. We're happy either way - and will be credited on the film, either way.

b). SHUCK & JIVE - A private investor group has agreed to finance this feature, with Hannover House serving as distributor, worldwide, in all media. Production is planned for June, 2014 with principal photography in Wichita, Memphis and N.W. Arkansas. Principal talent has not yet been signed.

c). MOTHER GOOSE - Pre-production continues to progress on this film; co-production (and financing) partnership agreements prohibit us from unilaterally disclosing more at this time. A formal press update is planned for Sundance in January.

d). THE MOTHMAN CHRONICLES - This creature-feature / thriller is currently in a hold-mode pending a work-out with private investors and the international distribution rights.

e). THE LEGEND OF BELLE STARR - Still in scripting stages; discussion underway regarding "how much dramatic license" can be taken to divert from historic record and surmised truths to tell a more compelling story with this movie?

f). SHADOW VISION - Pre-production will ramp up in January for a shoot in March; second unit sequences have already been shot and transferred to 4k file formats.

AUDIT & CORPORATE GOVERNANCE:

Company is in the process of hiring a new, full-time Controller / Bookkeeper to finish the reconciliation reports required by Hogan Taylor for the audit project. Previously candidates did not meet management's expectations or deadlines... and a recent attempt to utilize an outside accounting agency proved frustrating at best (they have been rarely available to come in and perform the required work); accordingly, the only way to get this finished is to cough-up the bucks for a qualified accountant, on staff, full-time, who understands the audit reporting format requirements. It is crucial to finish the accounting report items required by Hogan Taylor, in order that the audit be completed, and utilized for the Company's Form 10 Registration Filing with the S.E.C. The filing of the Form 10 will automatically elevate the stock to "OTCQB" status, and is expected to provide shareholder comfort and confidence with the Company's results.

CORPORATE FINANCING:

The Company is reviewing two financing proposals - each of which would provide an immediate, multi-million dollar cash infusion (without a negative impact to the A/S Equity Structure), and both of which would facilitate access to acquire and release high-profile "studio-level" films. There has been a lot of work over the past six weeks to bring these deals to the table - including a new distribution venture with 20th Century Fox Home Entertainment to accommodate the home media distribution portion of the structure; however, until a deal is done, there can be no assurance that one of these transactions will ultimately close and fund. Accordingly, the Company is pleased to continue on our proven course and business model of acquiring and distributing low-cost, direct-to-video releases and mid-level theatrical titles. With a broadening of Hannover's target "genre" releases (expanding from Sci-Fi / Horror to include Family, Drama, Comedy, Urban and Spanish titles), the Company is well positioned for substantial revenue growth in 2014 - even without one of these extraordinary "brass-ring" type of transformative ventures. There's a HUGE hole in the U.S. film distribution marketplace... the "major-independent" position that was previously occupied by LIONSGATE before they merged with SUMMIT to become (essentially) one of the new, Major Studios. The market contains about six "indies" in the lower-revenue spectrum... and six "Major Studios" in the stratosphere of mega-revenues... with no company occupying the $300-million to $500-million per year "Major Independent" spot. With continued hard work, the right product, and a little luck, Hannover House will strive to reach this position.

... more to come...

Mackenzie Foy, star of "PLASTIC JESUS" and the upcoming Christopher Nolan epic, "INTERSTELLAR."

Tuesday, October 22, 2013

Revised art for Redbox placement

In order to play up the "girlfriends - buddies" aspect of the movie more prominently, Hannover House has made changes to the key art for BLUES FOR WILLADEAN. Watch for this poignant and moving drama on DVD everywhere, January 21, 2014... a prime example of HHSE revenue growth through programming diversity...

Parade of New Release Products for HHSE...

The "core" business of DVD / Blu-Ray releases for Hannover House continues to grow... as we build on our successes with Sci-Fi / Horror films each month... and begin to rotate in new genres (that compete for different shelf space); these new genres will enable the company to grow our monthly revenues without cannibalizing our own schedule (which could occur if we tried, for instance, to release four horror titles in a given month, and thus force our key accounts to select "the best two" of the bunch).

New categories that will be more prominent for the company in 2014 are:

SPANISH LANGUAGE titles - URBAN APPEAL titles - DRAMA and COMEDY.

One interesting and emerging category in the marketplace is euphemistically referred to as "raunchy-comedy," fueled by the successes of titles such as "The Hangover", "Bachelorette" and the "National Lampoon" series. In this respect, Hannover House wishes to congratulate Keith Birkfeld, New Films International and the production team on the completion of "AMERICAN BEACH HOUSE" starring Mischa Barton... that's a home video hit in the making! Hannover House is working with New Films International on other titles they control... and we will be pursuing this new comedy as well.

Watch for a long and detailed blog for tomorrow, with lots of updates and issues as requested by shareholders!

New categories that will be more prominent for the company in 2014 are:

SPANISH LANGUAGE titles - URBAN APPEAL titles - DRAMA and COMEDY.

One interesting and emerging category in the marketplace is euphemistically referred to as "raunchy-comedy," fueled by the successes of titles such as "The Hangover", "Bachelorette" and the "National Lampoon" series. In this respect, Hannover House wishes to congratulate Keith Birkfeld, New Films International and the production team on the completion of "AMERICAN BEACH HOUSE" starring Mischa Barton... that's a home video hit in the making! Hannover House is working with New Films International on other titles they control... and we will be pursuing this new comedy as well.

Watch for a long and detailed blog for tomorrow, with lots of updates and issues as requested by shareholders!

Friday, October 4, 2013

Happy Holiday news from Hannover!

Pleased to have just received confirmation of two new December shipments into Walmart Stores: "AMITYVILLE ASYLUM" and "BLUES FOR WILLADEAN," both priced at $14.95 suggested retail, and in the new release section at only $9.96 each. These items will also contain a special offer from VUDU, in respect of the new agreement between Hannover House and this Walmart-owned streaming site. Great news for the holidays, and a great way to launch into a new year for HHSE! We will continue to build on this solid core business as we reach to fulfill the company's opportunity to become a dominant, major-independent supplier.

Amityville Asylum on sale date: Jan. 7, 2014; Blues for Willadean on sale date: Jan. 21, 2014

Amityville Asylum on sale date: Jan. 7, 2014; Blues for Willadean on sale date: Jan. 21, 2014

Don't know VooDoo Math, but do know that VUDU is going to be huge for HHSE!

(Guest Blog from Eric

Parkinson, CEO of Hannover House) - Good morning HHSE Friends, Shareholders

and Watchers - as is well-known, Hannover House is very open and receptive to

shareholder inquiries for clarification of public items. However, we do require identity verification before

responding to calls and emails, as has been suggested by the advisors currently

assisting the company. HHSE takes pride

in being extremely candid, open and accessible... to a level far exceeding most

public companies (and certainly unprecedented

for Pinksheet traded equities). That's

why it's confusing when shareholders occasionally criticize management for not being

transparent with information. To make

such a claim conflicts with the reality of the OTC disclosures, and almost

always appears as a thinly veiled attempt to manipulate the stock trading

price.

Yesterday, several "longs" emailed me to ask if I was planning to respond to a lengthy post that someone ("Mikeymgd"?) placed on the "IHUB" board (which I understand is an open forum for stock followers to discuss various equities). Hannover House and our management do not subscribe to or visit these "chat rooms" so we are reliant upon a verified shareholder to send us "posts" if they want a response. Late in the day, a verified shareholder finally provided me with the text of the post, and a request that I respond in respect of the lengthy effort made by the poster. So here goes! >>

The first issue that the poster raises is their personal opinion as to whether or not the company has "truly turned the corner." The following sentence in their post refers to lawsuits, so I'm going to presume that the barometer the poster is suggesting as being the measure of whether or not HHSE has "truly turned the corner" would be the status of lawsuits. As of today, there is only one (1) active and unresolved lawsuit affecting the company. This time last year, there were seven (7). If the poster feels that resolving lawsuits is the measure of success, then we arguably have satisfied this goal (or are at least extraordinarily close to having zero unresolved lawsuits). To be clear, the Company still owes money on prior legal matters and judgments; what we are referring to is disputed matters of adjudication still before the courts... we do not wish to imply that all prior lawsuits have been paid off as of this date.

The next statement made was about "acquiring movies." The poster said to "consider it fact once its (sic) available at Walmart, redbox (sic) or netflix(sic)." Their following sentence seems to elaborate on this position by stating that "too many items fall through prior to execution." In reviewing our announcements from the past 3-1/2 years, we were only able to identify two titles that were announced but ultimately not released (with forty-two titles announced and released or in active pre-release solicitation). The two titles that were abandoned were "HappyThankYouMorePlease" and "Wild Hunt." In the case of HTYMP, the producers were insisting on a 200-print theatrical opening and a major prints & ads expenditure which made no financial sense to Hannover House. With "Wild Hunt" the producers allowed the Canadian release to precede the USA schedule, with grey-good shipments of DVDs arriving into the US market. We believe that both decisions were in the best interests of the Company and shareholders. We also believe that having 95.3% of our announced acquisitions actually / eventually hitting the marketplace ranks HHSE in the highest echelon of all studios.

The poster then moves onto the issue of VODwiz, and warns shareholders to "not count your eggs until they hatch (sic)." The poster describes the "On-Demand" market as a "nitch" (sic) that represents only "1% divided amongst hundreds of on demand pay per view channels." People are entitled to have their own opinions - they can even jumble popular phrases and misspell words if they want - but they are not entitled to invent their own FACTS. Download the industry report from NPD Group if you want to see the actual breakout of this multi-billion dollar V.O.D. media; transactional on-demand is the fastest growing segment, and there and there are not "hundreds" of on demand pay per view channels. Most importantly, there's not a single legitimate competitor pursuing the VODwiz "breadth of selection" programming model. This poster goes on to predict that Hannover's VOD revenues will be "100k or less annually." Is he even reading our filings, blogs or reports at all? In its first week of "on-demand" placement, TOYS IN THE ATTIC generated $28,400... and our top VOD title last year ("All's Faire In Love") generated $238,000. Granted, some of the VODwiz titles are probably not going to be big revenue performers. But do the math, and use modest numbers. If we're generating an ultra-conservative $5,000 per title on average - with 2,500+ titles - that's $12,500,000 per year. The poster is asking people to find the projection of $4 per title / per year to be plausible? Such a prediction is wildly inconsistent with current VOD results for the company.

The poster then moves to the issue of debt reductions, and uses some data from selected quarters to attempt to paint a picture of increasing debts. Certainly, debt management has been a major issue for the Company, and the painful debts from the release of "Twelve" in 2010 have been quite a burden (thank God that we did not proceed with "HappyThankYouMorePlease" and end up doing it again!). Some adjustments to our debt reporting merit clarification. First of all, the company recently acknowledged three sizable debts that, in previous quarters, had been in dispute (or they were listed on the financials at their actual liability levels). Bedrock Ventures, Evelyn Smith and Interstar Releasing are three lawsuits that the Company ultimately lost due to defaults. As part of the lawsuit resolution, these debts were restated in filings to reflect the gross amount of the judgments (including legal fees and interest) as opposed to the contractual liability. Ironically, we are now being told by the audit team that the restatement of these debt amounts will likely need to be back-dated to the applicable period, as opposed to being recognized in 2013. Regardless, these items were not "newly acquired debts" as implied by the poster. They are newly "recognized" ledger entries, suggested by the audit team (and in two instances, required disclosures for settlement with the judgment creditors).

The Current Liabilities also reflect approx. $520,000 for TCA Funding as well as newly reconciled and accrued producer royalties. The TCA Funds have been used to move forward on ten new releases, revenues from which will be realized in Q4 (2013) and in Q1 (2014).

Again, going back to the poster's opening salvo of determining success by "turning the corner" in resolving lawsuits, the recognition of these previously disputed amounts was an important part of the lawsuit resolution. We disagree that these items represent that the Company is moving backwards. That said, there will be some significant adjustments "the other way" in Hannover's favor for Q3 and Q4 in that some payables obligations have been retired with debt conversions, settlements (at lower that booked payables levels) or otherwise corrected from account reconciliations. These are the types of ledger adjustments that occur when you're going through an audit process.

The poster then moves onto a chart of revenues for selected (and non-consecutive) quarters, in an attempt to support a prediction that the Company's revenues are declining. We would remind shareholders that there are four quarters to a year, and that a one-time adjustment for product returns (as occurred in Q2, 2013), does not indicate that sales are waning. Ironically, we are being told that the Q2 sales adjustment for returns may need to be applied to quarters in 2011 and early 2012, when the shipments for those particular items were accrued as sales (the eventual returns diminished the sales for those items, and may be more properly applied to the quarter that the sales were accrued, rather than a reporting period with different title shipments entirely). If these debits are applied to the prior reporting periods, then the sales curve for the Company is restored to a double-digit, year-over-year growth rate. FYI - On a going-forward basis, the Company is no longer accruing as sales the "gross dollar value" of shipments to key retailers... instead, we are applying a hold back for prospective product returns at an amount set by newly established historical levels. We will continue to account for sales on an accrual (rather than cash) basis, but will apply a hold-back reserve in order to avoid or minimize any future ledger adjustments. Again, these are issues that arise while undergoing the audit process, and are being done in order to provide reports in an accurate and auditable form.

Yesterday, several "longs" emailed me to ask if I was planning to respond to a lengthy post that someone ("Mikeymgd"?) placed on the "IHUB" board (which I understand is an open forum for stock followers to discuss various equities). Hannover House and our management do not subscribe to or visit these "chat rooms" so we are reliant upon a verified shareholder to send us "posts" if they want a response. Late in the day, a verified shareholder finally provided me with the text of the post, and a request that I respond in respect of the lengthy effort made by the poster. So here goes! >>

The first issue that the poster raises is their personal opinion as to whether or not the company has "truly turned the corner." The following sentence in their post refers to lawsuits, so I'm going to presume that the barometer the poster is suggesting as being the measure of whether or not HHSE has "truly turned the corner" would be the status of lawsuits. As of today, there is only one (1) active and unresolved lawsuit affecting the company. This time last year, there were seven (7). If the poster feels that resolving lawsuits is the measure of success, then we arguably have satisfied this goal (or are at least extraordinarily close to having zero unresolved lawsuits). To be clear, the Company still owes money on prior legal matters and judgments; what we are referring to is disputed matters of adjudication still before the courts... we do not wish to imply that all prior lawsuits have been paid off as of this date.

The next statement made was about "acquiring movies." The poster said to "consider it fact once its (sic) available at Walmart, redbox (sic) or netflix(sic)." Their following sentence seems to elaborate on this position by stating that "too many items fall through prior to execution." In reviewing our announcements from the past 3-1/2 years, we were only able to identify two titles that were announced but ultimately not released (with forty-two titles announced and released or in active pre-release solicitation). The two titles that were abandoned were "HappyThankYouMorePlease" and "Wild Hunt." In the case of HTYMP, the producers were insisting on a 200-print theatrical opening and a major prints & ads expenditure which made no financial sense to Hannover House. With "Wild Hunt" the producers allowed the Canadian release to precede the USA schedule, with grey-good shipments of DVDs arriving into the US market. We believe that both decisions were in the best interests of the Company and shareholders. We also believe that having 95.3% of our announced acquisitions actually / eventually hitting the marketplace ranks HHSE in the highest echelon of all studios.

The poster then moves onto the issue of VODwiz, and warns shareholders to "not count your eggs until they hatch (sic)." The poster describes the "On-Demand" market as a "nitch" (sic) that represents only "1% divided amongst hundreds of on demand pay per view channels." People are entitled to have their own opinions - they can even jumble popular phrases and misspell words if they want - but they are not entitled to invent their own FACTS. Download the industry report from NPD Group if you want to see the actual breakout of this multi-billion dollar V.O.D. media; transactional on-demand is the fastest growing segment, and there and there are not "hundreds" of on demand pay per view channels. Most importantly, there's not a single legitimate competitor pursuing the VODwiz "breadth of selection" programming model. This poster goes on to predict that Hannover's VOD revenues will be "100k or less annually." Is he even reading our filings, blogs or reports at all? In its first week of "on-demand" placement, TOYS IN THE ATTIC generated $28,400... and our top VOD title last year ("All's Faire In Love") generated $238,000. Granted, some of the VODwiz titles are probably not going to be big revenue performers. But do the math, and use modest numbers. If we're generating an ultra-conservative $5,000 per title on average - with 2,500+ titles - that's $12,500,000 per year. The poster is asking people to find the projection of $4 per title / per year to be plausible? Such a prediction is wildly inconsistent with current VOD results for the company.

The poster then moves to the issue of debt reductions, and uses some data from selected quarters to attempt to paint a picture of increasing debts. Certainly, debt management has been a major issue for the Company, and the painful debts from the release of "Twelve" in 2010 have been quite a burden (thank God that we did not proceed with "HappyThankYouMorePlease" and end up doing it again!). Some adjustments to our debt reporting merit clarification. First of all, the company recently acknowledged three sizable debts that, in previous quarters, had been in dispute (or they were listed on the financials at their actual liability levels). Bedrock Ventures, Evelyn Smith and Interstar Releasing are three lawsuits that the Company ultimately lost due to defaults. As part of the lawsuit resolution, these debts were restated in filings to reflect the gross amount of the judgments (including legal fees and interest) as opposed to the contractual liability. Ironically, we are now being told by the audit team that the restatement of these debt amounts will likely need to be back-dated to the applicable period, as opposed to being recognized in 2013. Regardless, these items were not "newly acquired debts" as implied by the poster. They are newly "recognized" ledger entries, suggested by the audit team (and in two instances, required disclosures for settlement with the judgment creditors).

The Current Liabilities also reflect approx. $520,000 for TCA Funding as well as newly reconciled and accrued producer royalties. The TCA Funds have been used to move forward on ten new releases, revenues from which will be realized in Q4 (2013) and in Q1 (2014).

Again, going back to the poster's opening salvo of determining success by "turning the corner" in resolving lawsuits, the recognition of these previously disputed amounts was an important part of the lawsuit resolution. We disagree that these items represent that the Company is moving backwards. That said, there will be some significant adjustments "the other way" in Hannover's favor for Q3 and Q4 in that some payables obligations have been retired with debt conversions, settlements (at lower that booked payables levels) or otherwise corrected from account reconciliations. These are the types of ledger adjustments that occur when you're going through an audit process.

| Category | ||||

| Q2 2012 | Q2 2013 | Change | Primary Adjustments | |

| Current | $ 2,071,238 | $ 2,251,858 | $ 180,620 | Added in $520k for accrued royalties and TCA |

| Long Term | $ 2,218,326 | $ 3,444,432 | $ 1,226,106 | Recognition of Judgments, restated by $1,116k |

| (Officer Totals) | $ 969,175 | $ 1,158,836 | $ 189,661 | Now accruing at 50% of prior rate |

| Total Liabilities | $ 4,289,564 | $ 5,696,290 | $ 1,406,726 | Includes $1.636-mm in ledger adjustments |

The poster then moves onto a chart of revenues for selected (and non-consecutive) quarters, in an attempt to support a prediction that the Company's revenues are declining. We would remind shareholders that there are four quarters to a year, and that a one-time adjustment for product returns (as occurred in Q2, 2013), does not indicate that sales are waning. Ironically, we are being told that the Q2 sales adjustment for returns may need to be applied to quarters in 2011 and early 2012, when the shipments for those particular items were accrued as sales (the eventual returns diminished the sales for those items, and may be more properly applied to the quarter that the sales were accrued, rather than a reporting period with different title shipments entirely). If these debits are applied to the prior reporting periods, then the sales curve for the Company is restored to a double-digit, year-over-year growth rate. FYI - On a going-forward basis, the Company is no longer accruing as sales the "gross dollar value" of shipments to key retailers... instead, we are applying a hold back for prospective product returns at an amount set by newly established historical levels. We will continue to account for sales on an accrual (rather than cash) basis, but will apply a hold-back reserve in order to avoid or minimize any future ledger adjustments. Again, these are issues that arise while undergoing the audit process, and are being done in order to provide reports in an accurate and auditable form.

The poster then states that the TCA line of credit will show

a higher debt amount in Q3. They are

mistaken, as the TCA funding is already included in the Q2 filings.

Lastly, and most revealing, the poster makes a pricing

prediction ($.01 per share), which he does not see as being positively affected without

some sort of "blockbuster" development. Well, taking into account the flaws in the

poster's analysis - and knowing that there are several major deals in the works

for HHSE - I would recommend that the poster pick-up the phone and call us

before spending hours in preparing a factually challenged (and loosely veiled "attack") on the Company and its

managers. We have no secrets or

nefarious agenda... but are naturally suspicious of anyone who

"anonymously" makes derogatory statements, and presents ill-willed

opinions as "fact."

There's never any guarantees that any particular Company will grow to

become hugely successful... or that the stock price will reflect its proper

value. But Hannover House has been

operating now for 20+ years, building the library, building the revenue

pipelines, and building into a position for major break-out and growth. Fred and I believe that the stock should be

north of $.10 per share... and we think the developments underway should ultimately convince

a majority of market traders. Maybe

we're right... maybe we'll be proven wrong... but we can never be accused of

not being forthright and open in telling shareholders the accurate status of

the Company to the fullest extent allowable at any given time. If the poster of yesterday's lengthy diatribe is a legitmate "long"

or actual shareholder, I invite them to call me and discuss any questions,

rather than expending hours of otherwise productive time picking-and-choosing

bits of misinformation to support a flawed hypothesis that the stock should not

be trading waaayyy higher than the current PPS levels.

While my feeling is that the poster has used "VooDoo" math in attempting to paint a tainted picture of HHSE, all I can say is to check out the growth rate of the Walmart "On-Demand" site, VUDU, if you want to know which direction the marketplace - and HHSE - is moving! We want to encourage shareholder inquiries: if you ever need actual clarification on disclosed items, just give us a call! Isn't your time worth it?

Wednesday, October 2, 2013

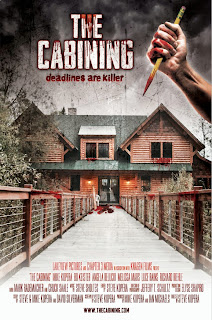

Consistent success with Horror-Thrillers builds steady supply.

One of our shareholders wrote an email about two years ago that was amusing at its obviousness but enlightening in its simplicity. He said: "Figure out what sort of films are making money for HHSE and put out more of those." This strategy only works when comparing apples-to-apples in terms of product levels (i.e., "direct-to-video", "mid-level theatrical" or "event-level-theatrical"). Without a big supply of P&A funds to make films "mid-level" or larger theatrical releases, most of Hannover's net revenues have been generated by direct-to-video titles over the past two years. And it should come as no surprise that the horror-thriller titles have been the best performers.

Hannover has released seven "horror" titles in the past 18-months, every one of which has generated significant revenues and bottom line for the company. That's why our upcoming release slate includes eight more (already announced) titles, with another eight or more in the queue as pending announcements. As our success with this genre' has grown, so have the caliber and quality of submissions from producers and agents. So you can expect to see our core direct-to-video business over the next couple of years continue to have a concentration on this horror-thriller genre.

That said, the company still feels that the brass-ring of big revenues will come from the mid-level (or higher) caliber releases, which is why the film / video direction the company is pursuing is a three-pronged strategy for 2014 / 2015 - i.e., 2 "core" level direct-to-DVD titles each month, one "mid-level" theatrical every sixty days, and one "major level" title each quarter. We believe that this release strategy is the proven formula to move the company into the level of "next major independent studio"... a market-spot that has been vacated since the ascension of Lionsgate and Summit into the "billion-dollar revenue club" of major-studio status.

Watch for announcements on new title acquisitions - especially mid-and-event level projects - and corporate ventures over the next few weeks. Meanwhile, we're lovin' the new film supply that the indie-production community keeps presenting for our DTV home video schedule!

http://chapter3media.com/cabining/drupal_cabining/

P.S., we appreciate shareholder suggestions, even those that might seem obvious! That said, no, we cannot make "our own Batman" movie... and no, we don't think "Francis The Talking Mule" is going to resonate with young theatrical audiences. But if there's a clearly identifiable and addressable market for a concept or project - and a means to deliver sales results in a cost-effective manner - we're definitely willing to discuss!

Hannover has released seven "horror" titles in the past 18-months, every one of which has generated significant revenues and bottom line for the company. That's why our upcoming release slate includes eight more (already announced) titles, with another eight or more in the queue as pending announcements. As our success with this genre' has grown, so have the caliber and quality of submissions from producers and agents. So you can expect to see our core direct-to-video business over the next couple of years continue to have a concentration on this horror-thriller genre.

That said, the company still feels that the brass-ring of big revenues will come from the mid-level (or higher) caliber releases, which is why the film / video direction the company is pursuing is a three-pronged strategy for 2014 / 2015 - i.e., 2 "core" level direct-to-DVD titles each month, one "mid-level" theatrical every sixty days, and one "major level" title each quarter. We believe that this release strategy is the proven formula to move the company into the level of "next major independent studio"... a market-spot that has been vacated since the ascension of Lionsgate and Summit into the "billion-dollar revenue club" of major-studio status.

Watch for announcements on new title acquisitions - especially mid-and-event level projects - and corporate ventures over the next few weeks. Meanwhile, we're lovin' the new film supply that the indie-production community keeps presenting for our DTV home video schedule!

http://chapter3media.com/cabining/drupal_cabining/

P.S., we appreciate shareholder suggestions, even those that might seem obvious! That said, no, we cannot make "our own Batman" movie... and no, we don't think "Francis The Talking Mule" is going to resonate with young theatrical audiences. But if there's a clearly identifiable and addressable market for a concept or project - and a means to deliver sales results in a cost-effective manner - we're definitely willing to discuss!

Subscribe to:

Posts (Atom)