It's not a simple task to persuade close to 1,000 people to drop what they're doing and go to a specific theatre on a specific weekend to see a specific movie. So KUDOS to the production team for "THE PRINCIPLE" on achieving exactly that and generating a per-screen average of more than $8,600 on initial launch. Watch this space for more details....

www.ThePrincipleMovie.com

Welcome

Welcome to the Hannover House Investor Relations Blog

Thursday, April 30, 2015

Wednesday, April 29, 2015

BONOBOS - Opens July 17 in top Theatres and Natural History Museums - From HHSE!

Dear HHSE Friends & Shareholders - the recent release of Disney's "MONKEY KINGDOM" has been very helpful in motivated selected theatres to request "BONOBOS" from Hannover House. While the Disney film did not set overall box office records, many theatres grossed well in excess of $10,000 for the opening weekend - and it is from this list of happy locations that Hannover House is receiving a lot of booking requests!

Here are some photos from the upcoming "BONOBOS: BACK TO THE WILD" and a project description. It is one of four titles opening in theatres this summer from Hannover House, and is expected to hit DVD, BluRay and Video-On-Demand during Q4 of this year.

DESCRIPTION – “BONOBOS: Back to the Wild” is the English-language adaption of French director Alain Tixier’s acclaimed documentary, “Beny: Back to the Wild” (a.k.a. “Bonobos”). The film tells the true story of naturalist Claudine André and her work in the Congo to protect the critically endangered bonobo apes. Sometimes mistakenly referred to as “pygmy Chimpanzees,” bonobos are actually a unique species of primate – and the closest cousin of all to mankind (with a shared genetic code that is 98.7% identical to humans).

Here are some photos from the upcoming "BONOBOS: BACK TO THE WILD" and a project description. It is one of four titles opening in theatres this summer from Hannover House, and is expected to hit DVD, BluRay and Video-On-Demand during Q4 of this year.

DESCRIPTION – “BONOBOS: Back to the Wild” is the English-language adaption of French director Alain Tixier’s acclaimed documentary, “Beny: Back to the Wild” (a.k.a. “Bonobos”). The film tells the true story of naturalist Claudine André and her work in the Congo to protect the critically endangered bonobo apes. Sometimes mistakenly referred to as “pygmy Chimpanzees,” bonobos are actually a unique species of primate – and the closest cousin of all to mankind (with a shared genetic code that is 98.7% identical to humans).

Over twenty years ago, Claudine André formed the Lola Ya

Bonobo Sanctuary deep in the forest of the central African nation of the

Democratic Republic of Congo. Political

unrest and civil war had taken a toll on the economy, and food was becoming

scarce. Villagers had grown more

aggressive in pursuing live game from the forest as a food source. Despite their status as a protected species,

adult bonobos were being slaughtered for “bush

meat” by poachers, who would often keep the baby apes for black-market sale

as exotic pets. With the support of the

government and local police, Claudine and her team have since rescued over 400

orphaned bonobos and placed them into protective care at her Lola Ya Bonobo Rescue

Center.

The film opens with the story of one young bonobo, Beni,

in the wilds of the equatorial forest with his extended bonobo tribe. Their carefree lives are soon interrupted

when poachers shoot and kill Beni’s mother, and kidnap and crate him for

sale. While in the custody of the

poachers, Beni is abused, teased and malnourished. However, before he can be sold and shipped

overseas, Claudine and a Congolese Policeman successfully locate the poachers

and confiscate the young bonobo.

At Lola Ya Bonobo, Beni is nursed back to health by his

new, human “mothers.” He befriends new

bonobo playmates, and over the coming years he learns survival skills that will

be needed when he reaches maturity. Ultimately, in a bittersweet parting from

Claudine and his Lola Ya Bonobo human family, the fully-grown adult Beni is

released back into the wild.

The story of Beni’s rescue, raising and release is true,

and was skillfully chronicled and re-enacted by acclaimed French documentary

filmmaker Alain Tixier. Shot over a six-month

period in the Congo – and featuring stunning visuals – the film presents the

most revealing look ever into the lives and loves of mankind’s closest

cousin. Claudine André and her

successful bonobo achievements have drawn comparisons to Jane Goodall’s work

with chimpanzees and Dian Fossey’s study of gorillas.

ABOUT THE ENGLISH PRODUCTION

& RELEASE – At the Cannes Film Festival in May of 2014, French

producers SND-Filmes and MC4 concluded the agreement to engage U.S.

producer-director Vivian Schilling to adapt the film for English-speaking

territories, and agreed to a distribution venture with Hannover House, Inc. for North America. Schilling had recently

completed the writing, producing and directing of an English adaptation of the

animated masterpiece “Na Pude,” by

Czech director-animator Jiri Barta.

Retitled as “Toys in the Attic,”

Schilling directed an impressive cast of English-speaking performers who

breathed new life into the discarded toys and knick-knacks that were the

characters of this eclectic film. Voice

talent included Forest Whitaker, Joan Cusack and Cary Elwes.

For “BONOBOS:

Back to the Wild,” Schilling created a version which combines English

narration for Claudine and Beni, with English-subtitles for some of the on camera dialogue. Her goal was to maintain the credibility of

the documentary elements of the film, by preserving the original production

language tracks which are in French and Congolese. The film is structured as a “docu-drama” as it contains some

re-enactments of actual events and features the unique perspective of showing

the world from the eyes of Beni the bonobo.

But the science in the film is all factual and the events are all

true. Most importantly, the film

presents a powerful and emotional message that should invoke passion and

support for this endangered species.

Through an

arrangement with North American distributor Hannover House, Inc., the completed

English-language release will be exhibited at mainstream commercial theatres as well as major Natural History Museums

prior to its release to the home video, video-on-demand and television

markets. 100% of the net revenues after distribution fees and releasing costs will be divided between the World Wildlife Fund and the Lola Ya

Bonobo Rescue Center, to assist with their important work to save and protect

the bonobo species.

TALENT & RECORDING

– Schilling engaged film star

REBECCA HALL (“Transcendence”, “Iron Man

3”, “Vicky Cristina Barcelona”) for the voice-role of “Claudine” to balance the superb performance of with

LUKE EVANS (“Hobbit”, “Dracula Untold”) as

Beni. Luke was recorded in February at

the WB DeLane Lea Studios in London. Rebecca

Hall was recorded at Warner Brothers Sync Sound in New York on March 31st.

The film will be mastered onto 2k D.C.P. format with Dolby surround sound

for maximum impact during the Museum exhibitions. Hannover House plans to premiere the film at

a special media event to be held in June in New York City, which is expected to

include the attendance of Claudine André, flying in from the Congo. The film will be launched to theatres and

Museums in top USA Markets commencing July 17.

The home video release will include both DVD and Blu-Ray formats and is

tentatively planned for October, 2015.

Tuesday, April 28, 2015

Update on Form 10 and other Corporate Matters

Greetings HHSE Friends & Shareholders - There has been some trepidation in the past few days as the maturation date of our Form 10 Registration is approaching (May 11), and HHSE has yet to make a public commentary or blog regarding the ongoing Hannover's revisions from S.E.C. Comments.

Here's some information that we can share with all of you:

1). 2014 Financials - added to the 2012 and 2013 filings. The S.E.C. said that our financials in the Form 10 needed to not be older than 135 days aged from the filing deadlines, and thus the need for the 2014 numbers to be added to our registration filing.

2). Auditor Notification - The audits for 2012 and 2013 were completed under an agreement between HHSE and Terry L. Johnson, CPA. The company only hired Johnson for those two specific years, and we stated at our shareholder's meeting that the plan for future periods was to utilize one of the larger auditing firms (now that a historic basis for prior years had been established). The company is also using one of the top Library Valuation firms for a revisit of the company's film & television library. The company will complete each of the S.E.C. comments to the Form 10 in time, and will submit the revisions and responses in the next few days. With respect to the 2014 numbers, these are being auditing by the new auditing firm (already underway and only a couple of days from completion). As a company in "pending registration status" (after filing but before ratification), the change of auditors does not require a Form 8 notification, but will be clearly shown in the revised Form 10 responses. The representative from the S.E.C. that HHSE has been working with assures us that the May 11 date will not be "reset" from acceptance, provided that HHSE responds to all comments sufficiently. Once HHSE is formally accepted as a fully reporting company, a change in auditors would require a Form 8 filing. However, until May 11, the Company is not subject to such requirements.

3). Litigation - Two legal actions against the company were served to HHSE in the last 24-hours. TCA Global Master Fund filed a lawsuit in an attempt to pressure HHSE into accepting what management deems to be a very undesirable "debt-conversion structure" for the retirement of their balance. HHSE has a much better plan, and has arranged for funds that will be tendered to TCA prior to the required response date of their lawsuit. We know our solution is better for shareholders, and we believe that TCA will likely agree. Separately, a lawsuit by the landlord of the office properties was served yesterday, and a resolution has already been structured.

As stated in our Form 10, there are no other active lawsuits, and the above two matters are (or have been) managed as part of the ordinary course of business. The aggressive "Tribune" action in early March was resolved with cash payments. Payments for other adjudicated matters (such as Interstar and Bedrock) have been on hold during the past few months (primarily due to the short-term "negative cash flow cycle" caused by having huge product sales that take months to collect on). Every once in awhile, a creditor grows impatient, then files something or takes some collections actions. In every situation for the past five years, HHSE managers have "managed" such events, and while doing so, the company has successfully reduced our 2010 debts (almost entirely related to the painful acquisition of "TWELVE") by $2.7-million dollars. You have to sell a LOT of DVD's to clear $2.7-million for debt service, and still grow the library, expand the ventures, and move the company forward. It hasn't been easy, and hasn't always been pretty, but the HHSE managers are a dedicated team that have gotten the job done.

4). New Activities & I.R. - Over the next few days (and more specifically, over the next few weeks and months) shareholders will start to see some impressive news and corresponding trading activities. There has been some outreach by HHSE management to a larger group of media investors and industry followers, and there is a good chance that the trading volume in HHSE will continue to trend upwards (as evidenced by the initial buy-ins that started on Monday). Next week, HHSE will make a formal announcement of the engagement of a top I.R. Advisory Firm, the caliber of which has us very, very excited. These media experts know the industry, and know the true-trajectory that HHSE is following... a path towards being the next Lionsgate with our core business, and the "indie Netflix" with our VODWIZ venture.

There will be separate Blogs and announcements over the next few days (including our soft-launch to consumers this weekend of VODWIZ as we add 50+ titles each week and build the total gross-ratings points / impressions in proportion with the title listings growth over the coming months).

WATCH WHAT HAPPENS>>>>!!!

Here's some information that we can share with all of you:

1). 2014 Financials - added to the 2012 and 2013 filings. The S.E.C. said that our financials in the Form 10 needed to not be older than 135 days aged from the filing deadlines, and thus the need for the 2014 numbers to be added to our registration filing.

2). Auditor Notification - The audits for 2012 and 2013 were completed under an agreement between HHSE and Terry L. Johnson, CPA. The company only hired Johnson for those two specific years, and we stated at our shareholder's meeting that the plan for future periods was to utilize one of the larger auditing firms (now that a historic basis for prior years had been established). The company is also using one of the top Library Valuation firms for a revisit of the company's film & television library. The company will complete each of the S.E.C. comments to the Form 10 in time, and will submit the revisions and responses in the next few days. With respect to the 2014 numbers, these are being auditing by the new auditing firm (already underway and only a couple of days from completion). As a company in "pending registration status" (after filing but before ratification), the change of auditors does not require a Form 8 notification, but will be clearly shown in the revised Form 10 responses. The representative from the S.E.C. that HHSE has been working with assures us that the May 11 date will not be "reset" from acceptance, provided that HHSE responds to all comments sufficiently. Once HHSE is formally accepted as a fully reporting company, a change in auditors would require a Form 8 filing. However, until May 11, the Company is not subject to such requirements.

3). Litigation - Two legal actions against the company were served to HHSE in the last 24-hours. TCA Global Master Fund filed a lawsuit in an attempt to pressure HHSE into accepting what management deems to be a very undesirable "debt-conversion structure" for the retirement of their balance. HHSE has a much better plan, and has arranged for funds that will be tendered to TCA prior to the required response date of their lawsuit. We know our solution is better for shareholders, and we believe that TCA will likely agree. Separately, a lawsuit by the landlord of the office properties was served yesterday, and a resolution has already been structured.

As stated in our Form 10, there are no other active lawsuits, and the above two matters are (or have been) managed as part of the ordinary course of business. The aggressive "Tribune" action in early March was resolved with cash payments. Payments for other adjudicated matters (such as Interstar and Bedrock) have been on hold during the past few months (primarily due to the short-term "negative cash flow cycle" caused by having huge product sales that take months to collect on). Every once in awhile, a creditor grows impatient, then files something or takes some collections actions. In every situation for the past five years, HHSE managers have "managed" such events, and while doing so, the company has successfully reduced our 2010 debts (almost entirely related to the painful acquisition of "TWELVE") by $2.7-million dollars. You have to sell a LOT of DVD's to clear $2.7-million for debt service, and still grow the library, expand the ventures, and move the company forward. It hasn't been easy, and hasn't always been pretty, but the HHSE managers are a dedicated team that have gotten the job done.

4). New Activities & I.R. - Over the next few days (and more specifically, over the next few weeks and months) shareholders will start to see some impressive news and corresponding trading activities. There has been some outreach by HHSE management to a larger group of media investors and industry followers, and there is a good chance that the trading volume in HHSE will continue to trend upwards (as evidenced by the initial buy-ins that started on Monday). Next week, HHSE will make a formal announcement of the engagement of a top I.R. Advisory Firm, the caliber of which has us very, very excited. These media experts know the industry, and know the true-trajectory that HHSE is following... a path towards being the next Lionsgate with our core business, and the "indie Netflix" with our VODWIZ venture.

There will be separate Blogs and announcements over the next few days (including our soft-launch to consumers this weekend of VODWIZ as we add 50+ titles each week and build the total gross-ratings points / impressions in proportion with the title listings growth over the coming months).

WATCH WHAT HAPPENS>>>>!!!

Thursday, April 23, 2015

Dark Awakening Trailer - to appear before "INSIDIOUS 3" at over a thousand theatres!

Dear HHSE Friends - the June 19 launch of "DARK AWAKENING" will have a showcase of exposure to horror fans, with the TRAILER placement at the head of the June 5th Universal / Focus Features release of "INSIDIOUS - CHAPTER 3." Regal Entertainment Group, Carmike and Cinemark are among the key theatre chains that have approved this "DARK AWAKENING" trailer placement, to be seen by MILLIONS of HORROR FANS!

Go HHSE!!

Go HHSE!!

Wednesday, April 22, 2015

Principal Photography starts this SUNDAY!

Congratulations to our supplier-partner PASEO MIRAMAR PICTURES on the commencement of principal photography on "A DOG AND PONY SHOW."

Terrific lead cast includes RALPH MACCHIO ("The Karate Kid", "My Cousin Vinny") and Academy Award Winner MIRA SORVINO ("Jackie Brown", "The Replacement Killers"). The film that readers of the script most often compare to "DOG AND PONY SHOW" to is the live-action, talking animals film "CATS & DOGS" (which grossed $93-mm at the USA Box Office and $203-mm World Wide - not counting Video and Television revenues!).

The venture with Paseo Miramar Pictures calls for HHSE to release "A DOG AND PONY SHOW" to approximately 600 theatres in February, 2016, with home video, V.O.D. and S.V.O.D. following in late spring, early summer. SHOULD BE A HUGE RELEASE!!

And that's a prediction "straight from the horse's mouth!"

Terrific lead cast includes RALPH MACCHIO ("The Karate Kid", "My Cousin Vinny") and Academy Award Winner MIRA SORVINO ("Jackie Brown", "The Replacement Killers"). The film that readers of the script most often compare to "DOG AND PONY SHOW" to is the live-action, talking animals film "CATS & DOGS" (which grossed $93-mm at the USA Box Office and $203-mm World Wide - not counting Video and Television revenues!).

The venture with Paseo Miramar Pictures calls for HHSE to release "A DOG AND PONY SHOW" to approximately 600 theatres in February, 2016, with home video, V.O.D. and S.V.O.D. following in late spring, early summer. SHOULD BE A HUGE RELEASE!!

And that's a prediction "straight from the horse's mouth!"

Tuesday, April 21, 2015

Why increase the HHSE A/S now?

Good Morning HHSE Friends - There has been some immediate concern and trepidation over the Company's increase in Authorized Share count (which was "upped" by almost 15% from 700-mm to 800-mm).

First of all, let's be clear that the Company is not issuing 100-mm new shares for release into the marketplace.

The Company has increased the A/S after discussions with the S.E.C. concerning conversion provisions for notes and officer loans which were disclosed in the Form 10, but for which no provision existed to address. Increasing the A/S now, during the registration review period (prior to May 11), saves the company the cost and time distraction of having to file a second registration document later; additionally, the contingent liability of conversion option needed to be addressed.

Back in February, the Company posed the question of increasing the A/S to Shareholders. This issue was brought up again at the Shareholder's Meeting in early March. The number of shareholders who called or emailed their feelings (whether "for" or "against" the concept of a modest A/S increase) represented approximately 10% of the outstanding shares (about 65-mm total count, based on our shareholder's list). The consensus was fairly evenly "split" between those who were against any form of A/S increase, and those who recognized that the company would need to have some degree of management flexibility. After 45-days, the Preferred Shareholders voted to approve the A/S increase.

How many new shares are about to hit the market? None.

When might new shares start to appear? It's possible that the company's full registration approval (May 11), could provide a basis for a $25,000 convertible note issued last year to mature more quickly. But the share quantity if exercised on that $25,000 note would be a very modest amount, and would not take the Company much closer to the previous 700-mm A/S/ ceiling. Also keep in mind that there's a 10-mm certificate from TCA that's scheduled to be retired next month, thus lowering the A/S by that amount.

So while a change in corporate A/S structure is assuredly going to be unpopular to some shareholders, the actual "real world impact" of new shares hitting the market is a false-impression, put forward only by those hoping to motivate low-priced sales. HHSE is on a tremendous fast-track for growth and volume. Just watch what happens over the coming month...

First of all, let's be clear that the Company is not issuing 100-mm new shares for release into the marketplace.

The Company has increased the A/S after discussions with the S.E.C. concerning conversion provisions for notes and officer loans which were disclosed in the Form 10, but for which no provision existed to address. Increasing the A/S now, during the registration review period (prior to May 11), saves the company the cost and time distraction of having to file a second registration document later; additionally, the contingent liability of conversion option needed to be addressed.

Back in February, the Company posed the question of increasing the A/S to Shareholders. This issue was brought up again at the Shareholder's Meeting in early March. The number of shareholders who called or emailed their feelings (whether "for" or "against" the concept of a modest A/S increase) represented approximately 10% of the outstanding shares (about 65-mm total count, based on our shareholder's list). The consensus was fairly evenly "split" between those who were against any form of A/S increase, and those who recognized that the company would need to have some degree of management flexibility. After 45-days, the Preferred Shareholders voted to approve the A/S increase.

How many new shares are about to hit the market? None.

When might new shares start to appear? It's possible that the company's full registration approval (May 11), could provide a basis for a $25,000 convertible note issued last year to mature more quickly. But the share quantity if exercised on that $25,000 note would be a very modest amount, and would not take the Company much closer to the previous 700-mm A/S/ ceiling. Also keep in mind that there's a 10-mm certificate from TCA that's scheduled to be retired next month, thus lowering the A/S by that amount.

So while a change in corporate A/S structure is assuredly going to be unpopular to some shareholders, the actual "real world impact" of new shares hitting the market is a false-impression, put forward only by those hoping to motivate low-priced sales. HHSE is on a tremendous fast-track for growth and volume. Just watch what happens over the coming month...

Monday, April 20, 2015

HHSE - OTC Markets Update - Monday, April 20, 2015

Good Morning HHSE Friends, and Happy April 20 -

Here's the word received this morning from the OTC Markets:

"We have finished reviewing your December 31, 2014 Report. Your company will be moved to the OTC Pink Current Information tier before the next market open."

Apologies for the drama resulting from having temporarily lost our Current Reporting Status. As disclosed, it was just a timing and filing matter... nothing nefarious or not easily addressed.

* * * * * * *

SPANISH DVD BONANZA - In response to the sales success of "ASALTO AL CINE" and the repricing success of the "ANTONIO AGUILAR COLECCION" - HHSE and Green Apple will be releasing TWO MORE Spanish Multipack DVD assortments this summer. Stay Tuned!

* * * * *

Here's the word received this morning from the OTC Markets:

"We have finished reviewing your December 31, 2014 Report. Your company will be moved to the OTC Pink Current Information tier before the next market open."

Apologies for the drama resulting from having temporarily lost our Current Reporting Status. As disclosed, it was just a timing and filing matter... nothing nefarious or not easily addressed.

* * * * * * *

SPANISH DVD BONANZA - In response to the sales success of "ASALTO AL CINE" and the repricing success of the "ANTONIO AGUILAR COLECCION" - HHSE and Green Apple will be releasing TWO MORE Spanish Multipack DVD assortments this summer. Stay Tuned!

* * * * *

Friday, April 17, 2015

OTC Markets Status - Restoring to Fully Current

Good Morning HHSE Friends, and YIKES! We were shocked yesterday to discover that our access to file the 12/31/2014 numbers onto the OTC Markets site was blocked due to a "lapse in subscription" access. We had previously been told that our UPLIST to the OTC QB (and the payment of $10,000) would be effective after the May 11 S.E.C. certification, and that we would no longer be required to maintain a subscription to the "Pinksheets" service. What was not clarified was the limbo-period that we find ourselves currently.

Accordingly, HHSE has renewed the Pinksheets subscription and rendered payment to the OTC Markets... simply so that we can get our year-end results posted, and be "restored" to CURRENT reporting status. This will be our LAST filing as a PINKSHEET Company, due to the imminent uplisting.

MEANWHILE, the "Chicken Littles" of the short-sellers world are going to try to paint a false image of this hiccup in the uplisting process. Don't listen to them... their agenda is malicious in trying to persuade legitimate shareholders to sell them shares below value. This housekeeping / listing issue with the OTC has already been addressed, and we're simply awaiting the restoral of our access to post the financials (which will immediately restore CURRENT information / Full Pinksheets status).

Accordingly, HHSE has renewed the Pinksheets subscription and rendered payment to the OTC Markets... simply so that we can get our year-end results posted, and be "restored" to CURRENT reporting status. This will be our LAST filing as a PINKSHEET Company, due to the imminent uplisting.

MEANWHILE, the "Chicken Littles" of the short-sellers world are going to try to paint a false image of this hiccup in the uplisting process. Don't listen to them... their agenda is malicious in trying to persuade legitimate shareholders to sell them shares below value. This housekeeping / listing issue with the OTC has already been addressed, and we're simply awaiting the restoral of our access to post the financials (which will immediately restore CURRENT information / Full Pinksheets status).

Thursday, April 16, 2015

Question from Annual Shareholder's Meeting - Finally Responded...

Good evening HHSE Friends & Shareholders. At the Annual Meeting of Shareholders last month, a question was posed about the financing structure of some of the "bigger" productions on the HHSE slate, and why management doesn't consider these to be risky activities. Management responded to the question by promising to post an explanation and chart to show why this structure poses no reasonable (or real) risk to HHSE, but instead posits only an upside.

We will use "THE SUMMONING" as an example.

The Summoning is a film that by all ordinary measures, is functionally a $4-million dollar production. However, clever deal-making by the producer and director (including waivers, facility participations and deferrals) has made it possible to produce the film for a budget which qualifies for the S.A.G. Low-Budget rates (which is important for saving another $100k or so). The production budget for the film has been REDACTED from the graphic above - as have other proprietary details, such as the value of the forecasts or commitments from third party partners.

Structurally, a private lending group is financing the movie. HHSE ends up with all worldwide rights... BUT... the International is being sublicensed to The Little Film Company and the Subscription Video-On-Demand is being licensed to Netflix through FreeStyle Digital Media. Hannover House has agreed to issue a "standby" guarantee to the lenders for the full amount of their funding, e.g., $2-mm. However, the value of the sales and revenue sources EXCEEDS the guarantee, SO - the exercise of a call on the HHSE guarantee would be contingent upon a third party default or shortfall in revenues. Technically, there is risk to HHSE, but the risk has been mitigated with presales, contractual commitments, rebates and revenues.

"This is a lot of work for one movie" one shareholder said recently. "Why deal with all these production and financing steps when Medallion Releasing have 90+ other titles?"

That's a fair question, but one which ignores the marketplace reality that has a specific limitation on the amount of Video and V.O.D. revenues that are obtainable from direct-to-video properties. For Hannover House to step up to the next level as a major independent, we need mainstream theatrical titles that have a wide (500+ print) theatrical launch. It's these sorts of titles that become the locomotives to drive the revenues and pull-through promotions for the catalog and lower-stature properties. While a movie like "AMERICAN JUSTICE" can achieve placement at Walmart and Redbox, the quantity of units as a direct-to-video release are relatively small when compared against the volume of a 600-title theatrical release like "THE SUMMONING." Revenue wise, physical home video sales are more than 7-times greater for nationwide theatrical titles than direct-to-video releases. And in the case of "THE SUMMONING," there's a lucrative home as a Netflix subscription property following its theatrical release.

It's titles like "THE SUMMONING" and "MOTHER GOOSE" that will elevate HHSE into a much larger revenue position - where $50-mm to $100-mm in annual sales becomes both realistic and obtainable. The core direct-to-video business will always be a good bread-and-butter business... but the sizzle - and the steak - is likely to come from well-structured, high-profile titles for Hannover House in 2015, 2016 and beyond.

We will use "THE SUMMONING" as an example.

The Summoning is a film that by all ordinary measures, is functionally a $4-million dollar production. However, clever deal-making by the producer and director (including waivers, facility participations and deferrals) has made it possible to produce the film for a budget which qualifies for the S.A.G. Low-Budget rates (which is important for saving another $100k or so). The production budget for the film has been REDACTED from the graphic above - as have other proprietary details, such as the value of the forecasts or commitments from third party partners.

Structurally, a private lending group is financing the movie. HHSE ends up with all worldwide rights... BUT... the International is being sublicensed to The Little Film Company and the Subscription Video-On-Demand is being licensed to Netflix through FreeStyle Digital Media. Hannover House has agreed to issue a "standby" guarantee to the lenders for the full amount of their funding, e.g., $2-mm. However, the value of the sales and revenue sources EXCEEDS the guarantee, SO - the exercise of a call on the HHSE guarantee would be contingent upon a third party default or shortfall in revenues. Technically, there is risk to HHSE, but the risk has been mitigated with presales, contractual commitments, rebates and revenues.

"This is a lot of work for one movie" one shareholder said recently. "Why deal with all these production and financing steps when Medallion Releasing have 90+ other titles?"

That's a fair question, but one which ignores the marketplace reality that has a specific limitation on the amount of Video and V.O.D. revenues that are obtainable from direct-to-video properties. For Hannover House to step up to the next level as a major independent, we need mainstream theatrical titles that have a wide (500+ print) theatrical launch. It's these sorts of titles that become the locomotives to drive the revenues and pull-through promotions for the catalog and lower-stature properties. While a movie like "AMERICAN JUSTICE" can achieve placement at Walmart and Redbox, the quantity of units as a direct-to-video release are relatively small when compared against the volume of a 600-title theatrical release like "THE SUMMONING." Revenue wise, physical home video sales are more than 7-times greater for nationwide theatrical titles than direct-to-video releases. And in the case of "THE SUMMONING," there's a lucrative home as a Netflix subscription property following its theatrical release.

It's titles like "THE SUMMONING" and "MOTHER GOOSE" that will elevate HHSE into a much larger revenue position - where $50-mm to $100-mm in annual sales becomes both realistic and obtainable. The core direct-to-video business will always be a good bread-and-butter business... but the sizzle - and the steak - is likely to come from well-structured, high-profile titles for Hannover House in 2015, 2016 and beyond.

What do you think? Could "CITY OF FRIENDS" a big Kids-Video HIT in the USA?

"CITY OF FRIENDS" is a 52-episode animated kids series that has already proven itself as a worldwide hit! Available now for the first time in the USA, it looks to have a similar pedigree to shows such as "BARNEY" or "DORA THE EXPLORER."

There is some chatter about a possible daily BROADCAST of the episodes on a major USA Television Network, as both a revenue source as well as a promotional vehicle to drive DVD and Bluray sales through traditional mass merchant retailers (the "Barney" model).

Hannover House has generally shied away from animated properties - as they typically take many years and many millions to produce. But this is a done-series (plus two feature length holiday specials). That is what is making it look very interesting!

CHECK OUT THE TRAILER:

https://www.youtube.com/watch?v=GtdWDS83zS8

There is some chatter about a possible daily BROADCAST of the episodes on a major USA Television Network, as both a revenue source as well as a promotional vehicle to drive DVD and Bluray sales through traditional mass merchant retailers (the "Barney" model).

Hannover House has generally shied away from animated properties - as they typically take many years and many millions to produce. But this is a done-series (plus two feature length holiday specials). That is what is making it look very interesting!

CHECK OUT THE TRAILER:

https://www.youtube.com/watch?v=GtdWDS83zS8

Thursday, April 9, 2015

DARK AWAKENING - Coming to theatres June 19 from Hannover House

Hannover House is pleased to announce the June 19, 2015 theatrical launch of

"DARK AWAKENING" - a powerful thriller from the Executive

Producer of "THE RING" and director Dean C. Jones (the

visual effects maven responsible for "X-MEN: FIRST CLASS",

"OUIJA" and "PIRATES OF THE CARIBBEAN").

The film stars LANCE HENDRICKSON ("Aliens", Terminator") and

VALERIE AZLYNN ("Poseidon", "Tropic Thunder").

DARK AWAKENING is the first HORROR genre theatrical release EVER for Hannover House, and the biggest non-documentary theatrical release for the Company in the past five years!

* * * * *

LINK TO TEASER TRAILER (Note: Temporary Audio Mix) / TEASER POSTER ART.

FINAL (Mixed) TRAILERS AND PRINTED POSTERS WILL SHIP TO THEATRES ON APRIL 27.

https://www.youtube.com/watch?v=vwPg2R8jNGU

DARK AWAKENING is the first HORROR genre theatrical release EVER for Hannover House, and the biggest non-documentary theatrical release for the Company in the past five years!

* * * * *

LINK TO TEASER TRAILER (Note: Temporary Audio Mix) / TEASER POSTER ART.

FINAL (Mixed) TRAILERS AND PRINTED POSTERS WILL SHIP TO THEATRES ON APRIL 27.

https://www.youtube.com/watch?v=vwPg2R8jNGU

| DARK AWAKENING | |||||

| USA LAUNCH - TARGETED THEATRICAL RELEASE MARKETS | |||||

| Target | |||||

| Rank | DMA Name | TV Homes | US Mkt | Locations | |

| 1 | New York (Buroughs & Greater Metro) | 7,461,030 | 6.44% | 15 | |

| 2 | Los Angeles (Valleys, OC and Metro) | 5,665,780 | 4.89% | 15 | |

| 3 | Chicago (Greater Metro) | 3,534,080 | 3.05% | 8 | |

| 4 | Philadelphia (Greater Metro) | 2,963,500 | 2.56% | 5 | |

| 5 | Dallas-Ft. Worth | 2,655,290 | 2.29% | 8 | |

| 6 | San Francisco - Oak - Santa Cruz | 2,518,900 | 2.18% | 7 | |

| 7 | Boston / Manchester | 2,433,040 | 2.10% | 3 | |

| 8 | Washington, D.C. / Hagerstown | 2,412,250 | 2.08% | 4 | |

| 9 | Atlanta | 2,375,050 | 2.05% | 6 | |

| 10 | Houston | 2,289,360 | 1.98% | 6 | |

| 11 | Detroit | 1,856,400 | 1.60% | 3 | |

| 12 | Phoenix / Prescott | 1,855,310 | 1.60% | 4 | |

| 13 | Seattle-Tacoma | 1,847,780 | 1.60% | 4 | |

| 14 | Tampa-St. Petersburg-Sarasota | 1,827,510 | 1.58% | 3 | |

| 15 | Minneapolis-St. Paul | 1,748,070 | 1.51% | 3 | |

| 16 | Denver-Boulder-Co. Springs | 1,574,610 | 1.36% | 3 | |

| 17 | Miami-Ft. Lauderdale | 1,663,290 | 1.44% | 2 | |

| 18 | Cleveland-Akron (Canton) | 1,484,530 | 1.28% | 3 | |

| 19 | Orlando-Daytona Bch-Lebrn | 1,490,380 | 1.29% | 3 | |

| 20 | Sacramnto-Stkton-Modesto | 1,387,950 | 1.20% | 3 | |

| 21 | St. Louis | 1,254,530 | 1.08% | 2 | |

| 22 | Portland | 1,185,160 | 1.02% | 2 | |

| 23 | Pittsburgh | 1,181,540 | 1.02% | 2 | |

| 24 | Charlotte | 1,157,920 | 0.98% | 3 | |

| 25 | Indianapolis | 1,119,760 | 0.95% | 3 | |

| 26 | Raleigh-Durham (Fay) | 1,165,120 | 1.01% | 2 | |

| 27 | Baltimore | 1,095,240 | 0.95% | 2 | |

| 28 | San Diego | 1,080,880 | 0.93% | 3 | |

| 29 | Nashville | 1,043,440 | 0.90% | 2 | |

| 30 | Hartford-New Haven | 999,990 | 0.86% | 2 | |

| 31 | Salt Lake City | 921,240 | 0.80% | 5 | |

| 32 | Kansas City | 941,980 | 0.81% | 3 | |

| 33 | Cincinnatti - Mason (Metro) | 908,440 | 0.78% | 2 | |

| 34 | Columbus | 928,530 | 0.80% | 2 | |

| 35 | Milwaukee | 916,590 | 0.79% | 1 | |

| 36 | Greenville-Asheville-Sprtnbrg | 849,340 | 0.73% | 1 | |

| 37 | San Antonio | 906,210 | 0.78% | 2 | |

| 38 | West Palm Beach-Ft. Pierce | 809,640 | 0.70% | 1 | |

| 39 | Grand Rapids-Kalmzoo-B. Crk | 734,480 | 0.63% | 1 | |

| 40 | Austin | 733,390 | 0.63% | 2 | |

| 41 | Oklahoma City | 730,020 | 0.63% | 2 | |

| 42 | Las Vegas | 726,010 | 0.63% | 3 | |

| 43 | Harrisburg-Lancaster-Lebanon | 725,340 | 0.63% | 1 | |

| 44 | Birmingham (Montg / Tusc) | 719,200 | 0.62% | 2 | |

| 45 | Norfolk-Portsmth-Virginia Beach | 718,930 | 0.62% | 2 | |

| 47 | Albuquerque-Santa Fe, NM | 690,740 | 0.60% | 2 | |

| 48 | Jacksonville, FL | 675,650 | 0.58% | 1 | |

| 49 | Louisville, KY | 674,950 | 0.58% | 1 | |

| 50 | Memphis, TN | 672,390 | 0.58% | 2 | |

| 55 | Fresno / Visalia / Bakersfield | 580,180 | 0.50% | 2 | |

| 56 | Little Rock | 571,040 | 0.49% | 2 | |

| 57-100 | Additional Markets to Target Demo | Various | 26 | ||

| 101 | Fayetteville-Rogers-Springdale | 302,920 | 0.26% | 3 | |

| 78,764,900 | 67.97% | 200 | |||

Wednesday, April 8, 2015

Shipping to Retailers this week - From Hannover House

Good morning HHSE Friends - following our impressive Q1 schedule and results, HHSE continues to fire-away with sales and releasing momentum into Q2. Already shipping out for April release and billings are these THREE titles... with five more April shipments in queue! New Shipments to key Retailers and Wholesalers this week from Hannover House include:

MIDNIGHT HORROR SHOW - "Completely Insane... A Horror Masterpiece" - HorrorNews.com

NEXT UP - COMEDY FROM THE SUNSET STRIP - (hosted by Alex Thomas)

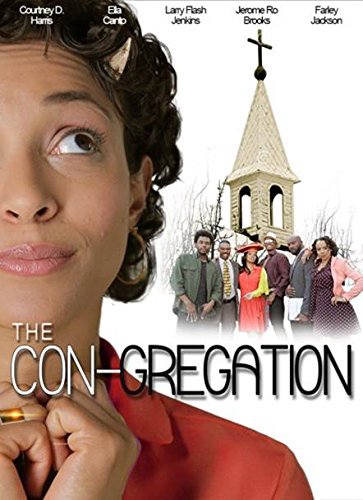

THE CON-GREGATION - Courtney D. Harris in an irreverent, urban-appeal drama.

This consistent volume of monthly releases builds the retailer credibility and market-share for Hannover House and Medallion Releasing... as well as expanding the company's Film & Television Library at warp speed... creating immediate revenues and long-term value for our shareholders!

MIDNIGHT HORROR SHOW - "Completely Insane... A Horror Masterpiece" - HorrorNews.com

NEXT UP - COMEDY FROM THE SUNSET STRIP - (hosted by Alex Thomas)

THE CON-GREGATION - Courtney D. Harris in an irreverent, urban-appeal drama.

This consistent volume of monthly releases builds the retailer credibility and market-share for Hannover House and Medallion Releasing... as well as expanding the company's Film & Television Library at warp speed... creating immediate revenues and long-term value for our shareholders!

Monday, April 6, 2015

HHSE & Medallion Studios BURNING-UP the Summer DVD Bins & Modulars!

Good Morning HHSE Friends - Proving once again that there's ENORMOUS STRENGTH in Numbers, HHSE and our Medallion Partner Studios are pounding home-runs at a record pace with growing placement momentum for NEW RELEASES, CATALOG PROMOTIONS and REPRICINGS for the Mass Merchant Budget Bins and Modulars. In addition to the Company's lead new releases, the July - August offerings for Walmart, Best Buy, Sams and Target will feature these eighteen (18) new items and new promotions.

One of the HHSE key account buyers called the transformation of the company's release slate and volume "ASTOUNDING" last week. Yes, astounding indeed! Go HHSE!!

One of the HHSE key account buyers called the transformation of the company's release slate and volume "ASTOUNDING" last week. Yes, astounding indeed! Go HHSE!!

Subscribe to:

Posts (Atom)